Why our Save account

What's in it for you

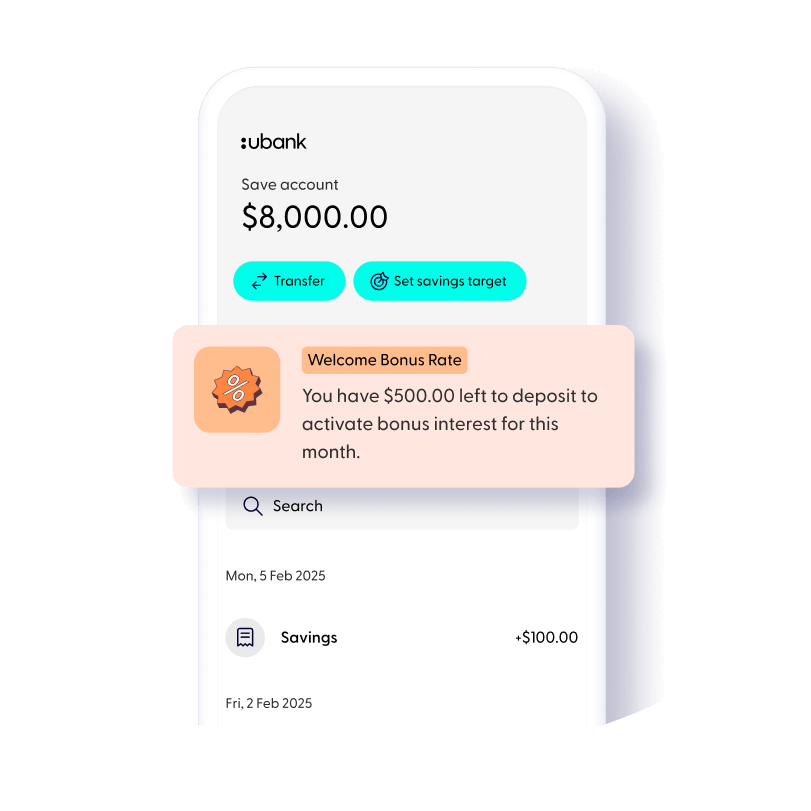

Our great savings interest rate

What makes up our total interest rate

Want bonus interest on all your Save accounts?

Why ubank

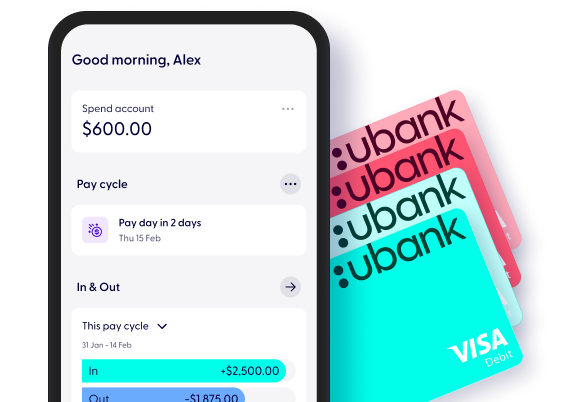

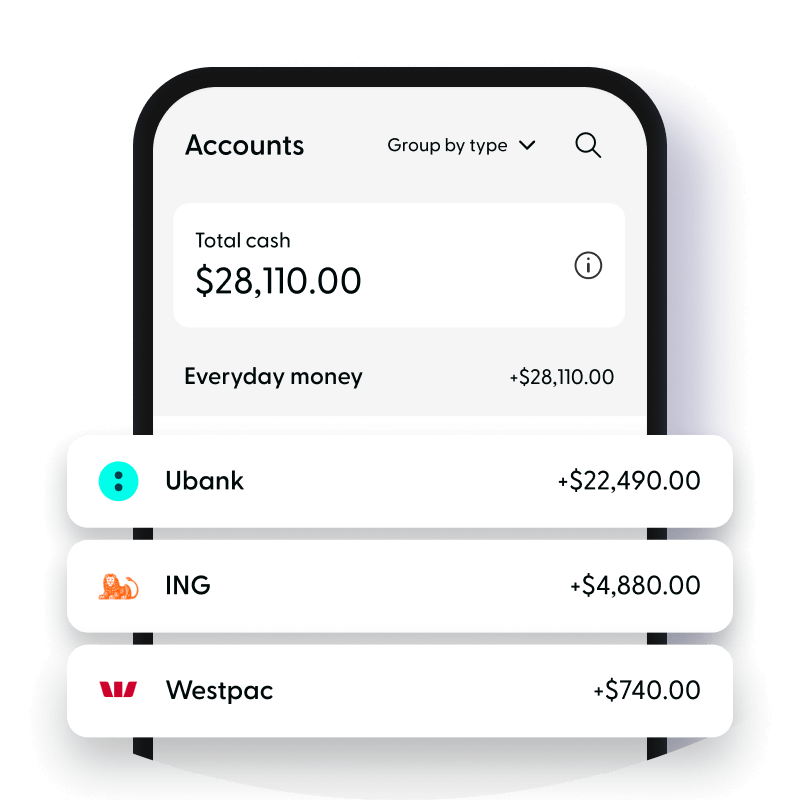

See your money clearly

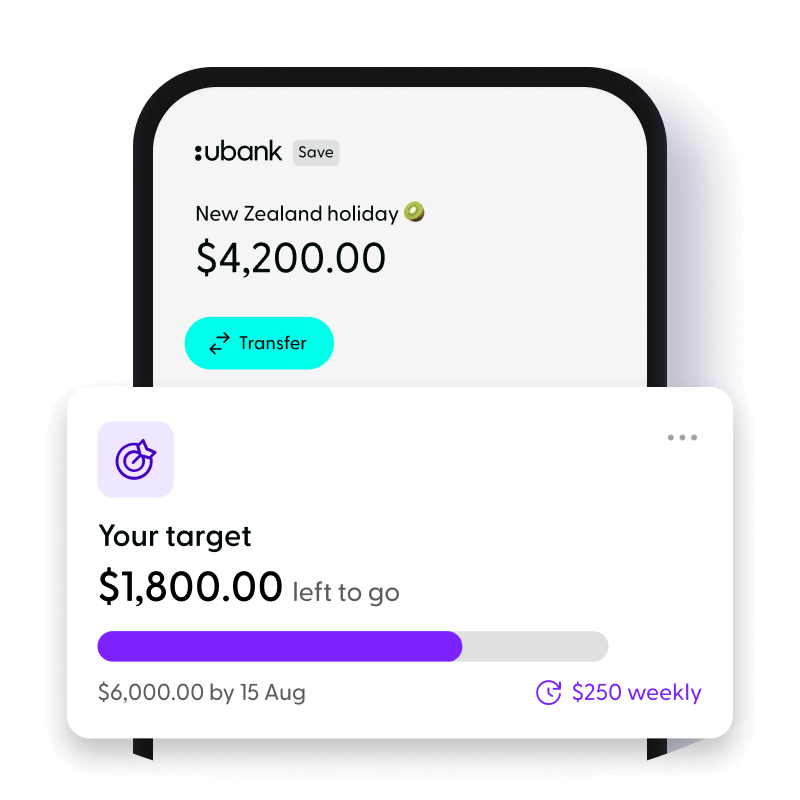

Hit all your savings targets, right on the money

Almost instant access to your savings when you need it

It’s okay to see other banks

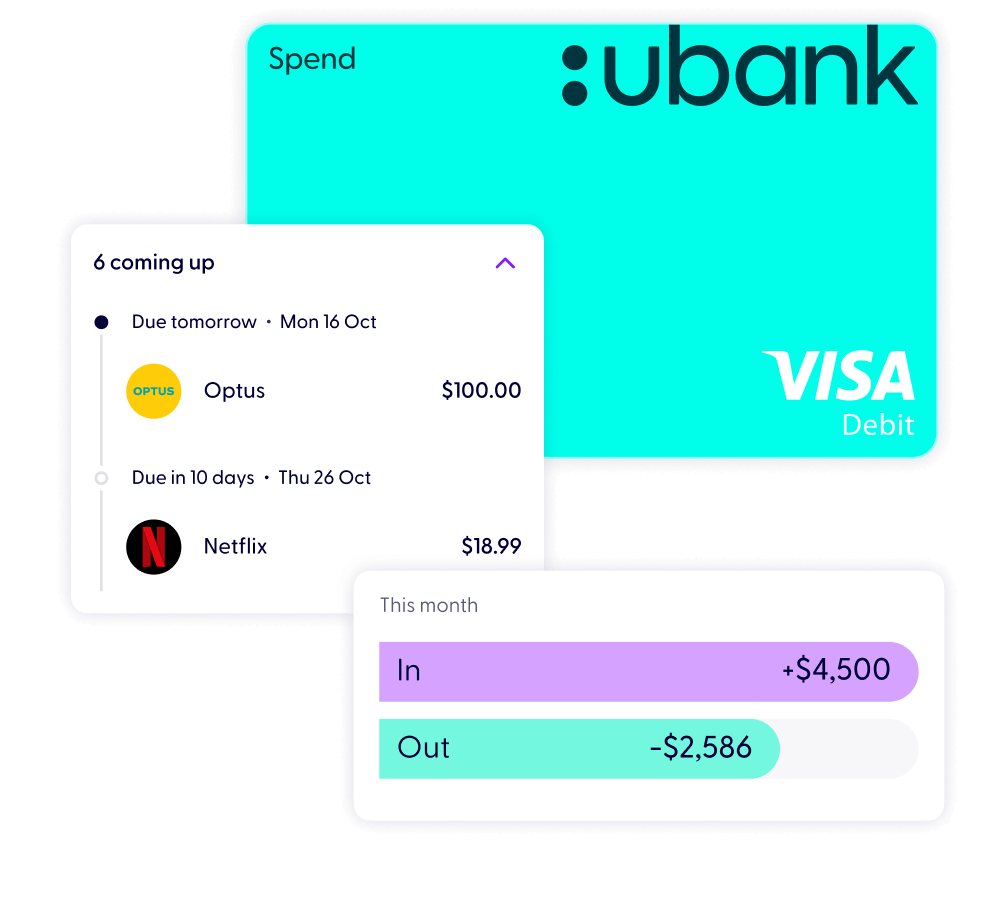

Plus get 2 more accounts, a Spend and a Bills

Join us