Why our Shared account

What's in it for you

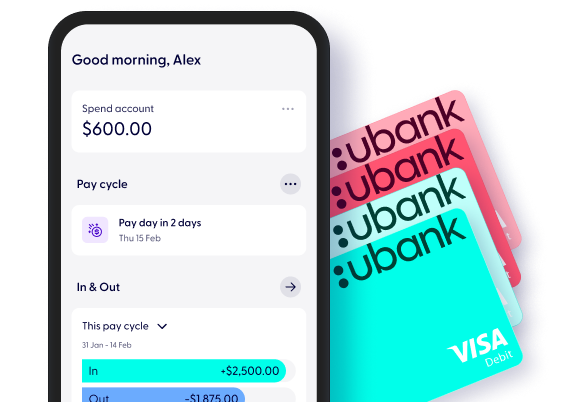

Multiple twin cards to keep track of what's what

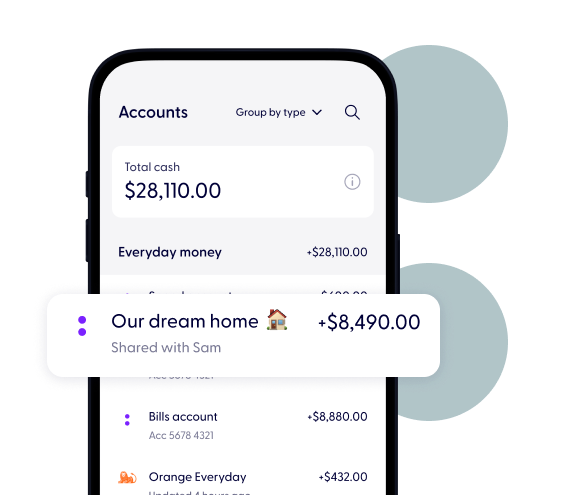

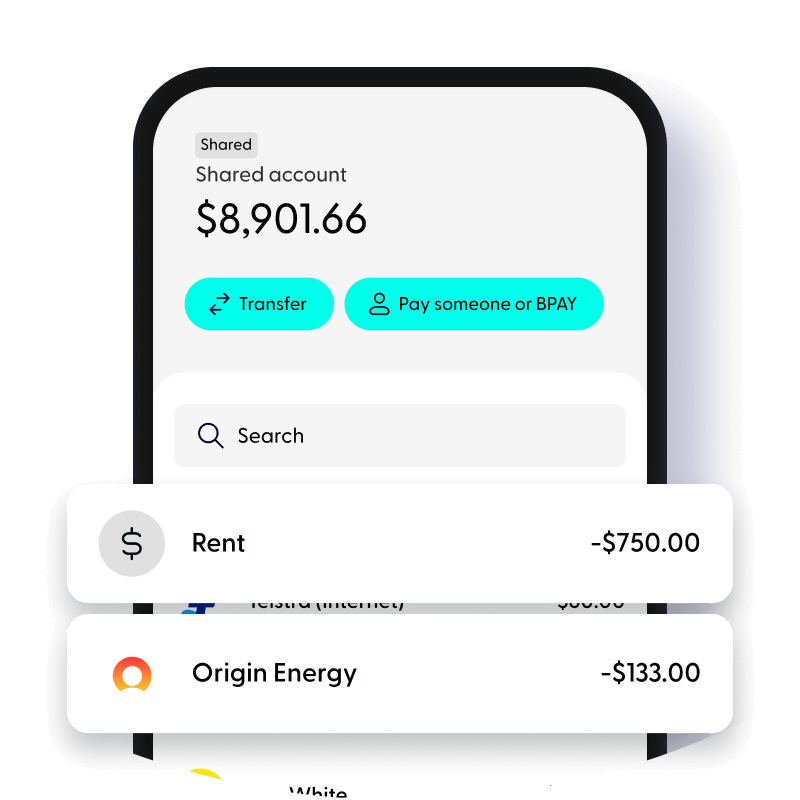

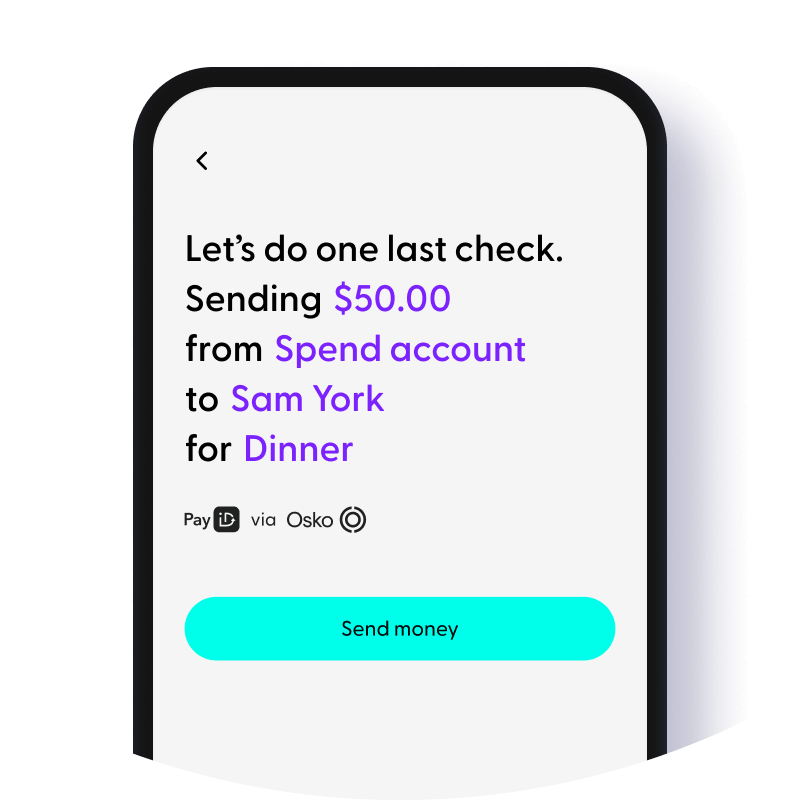

App experience

Explore how we're different

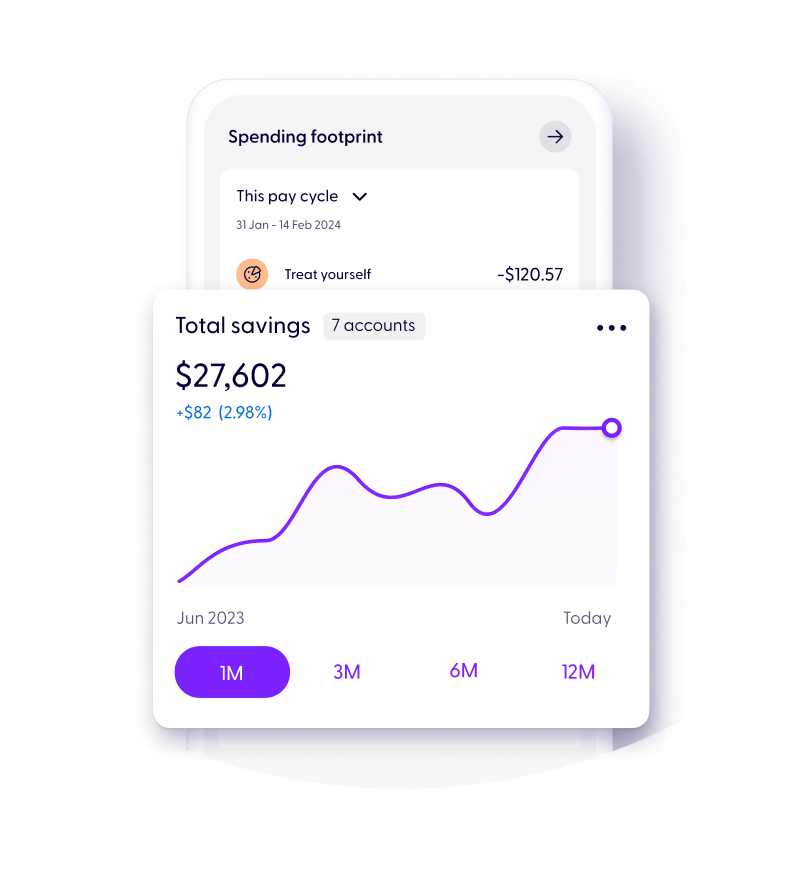

Watch your savings grow together

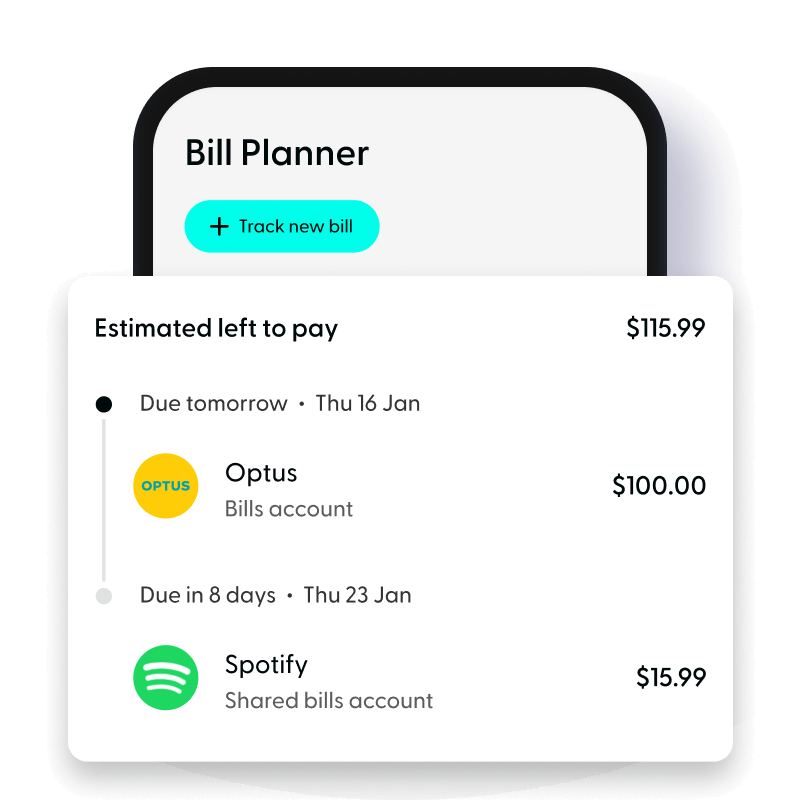

Split the bill with a Shared Bills account

No more endless transfers

Start using your Shared account straight away

Join us

How to open a Shared account