Why our Shared account

What's in it for you

Multiple twin cards to keep track of what's what

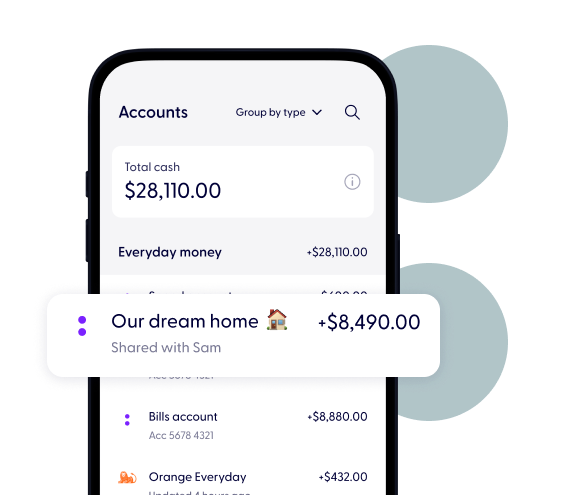

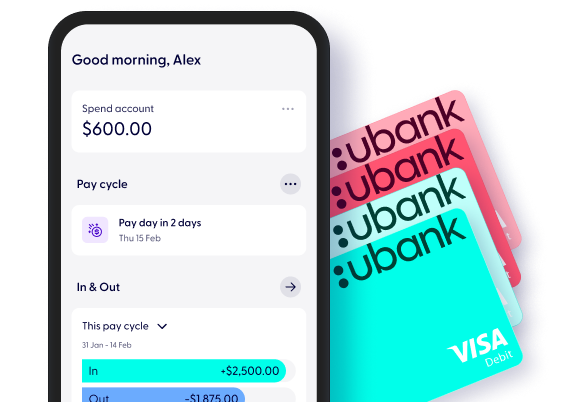

App experience

Explore how we're different

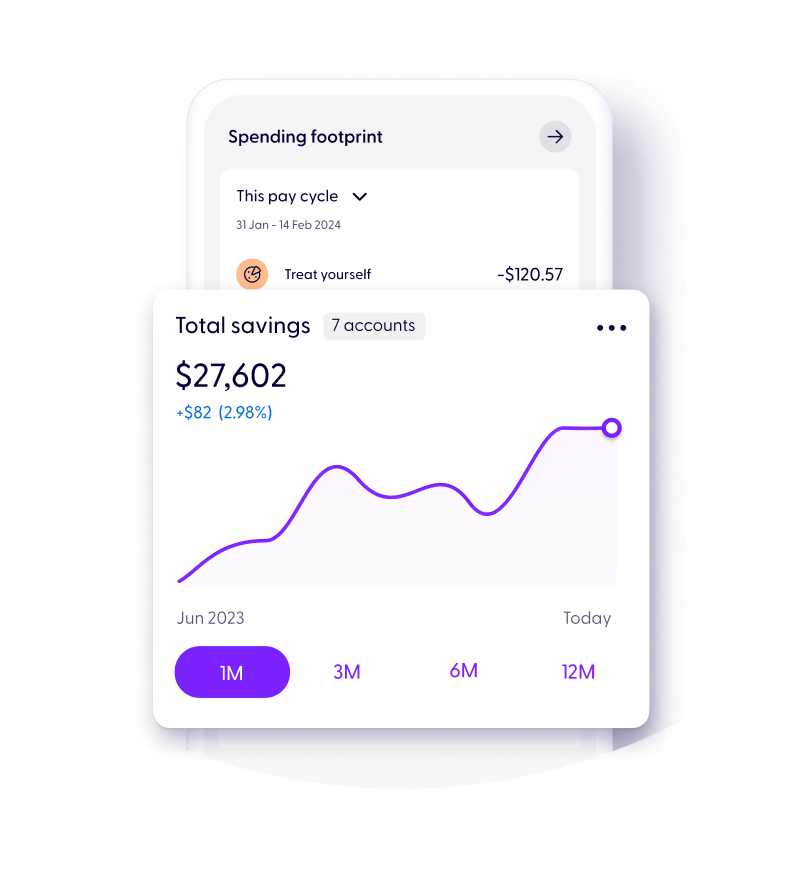

Watch your savings grow together

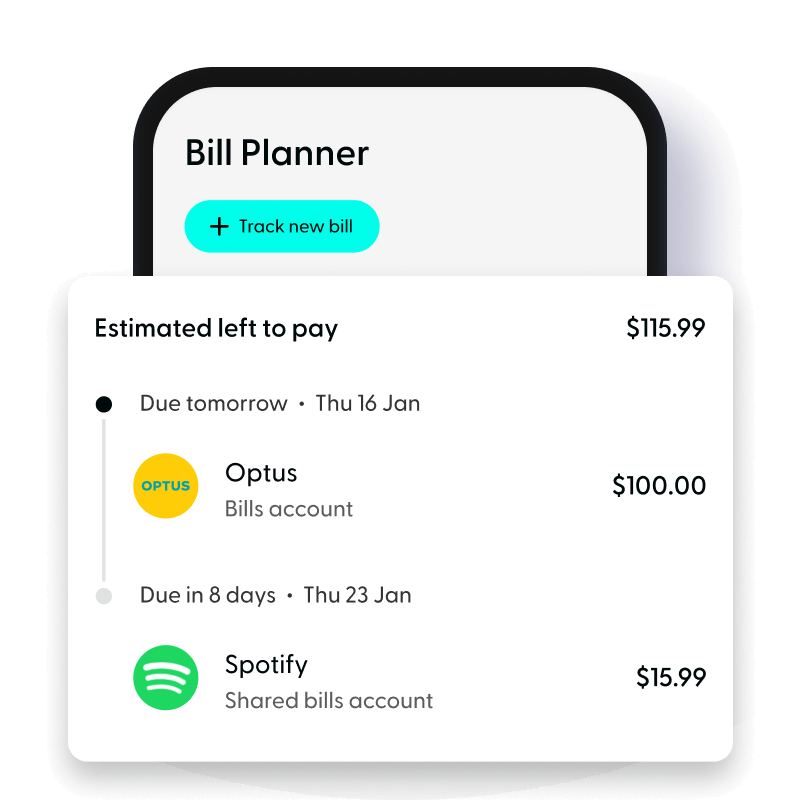

Split the bill with a Shared Bills account

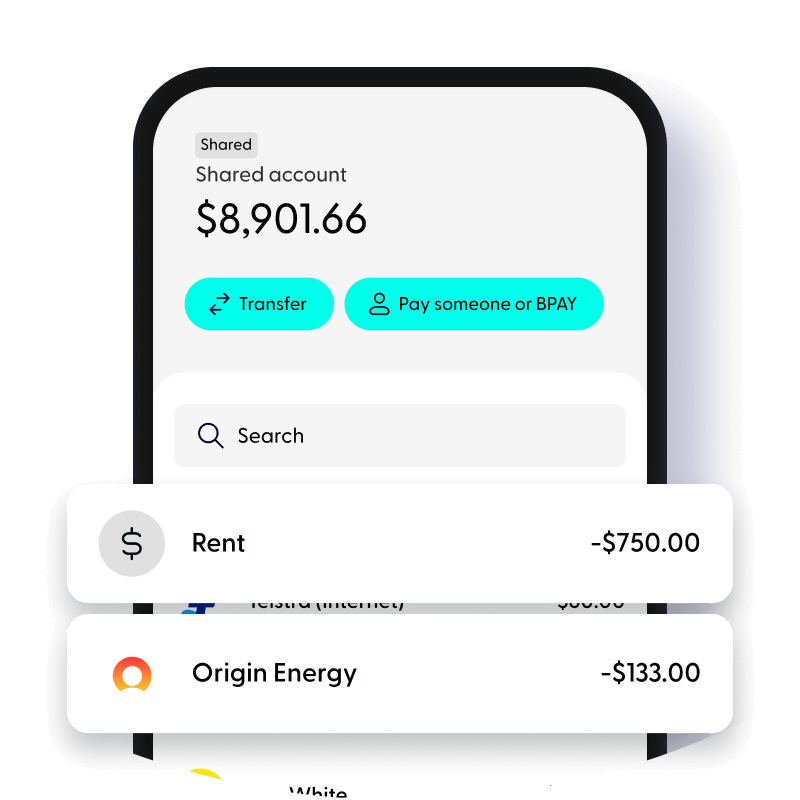

No more endless transfers

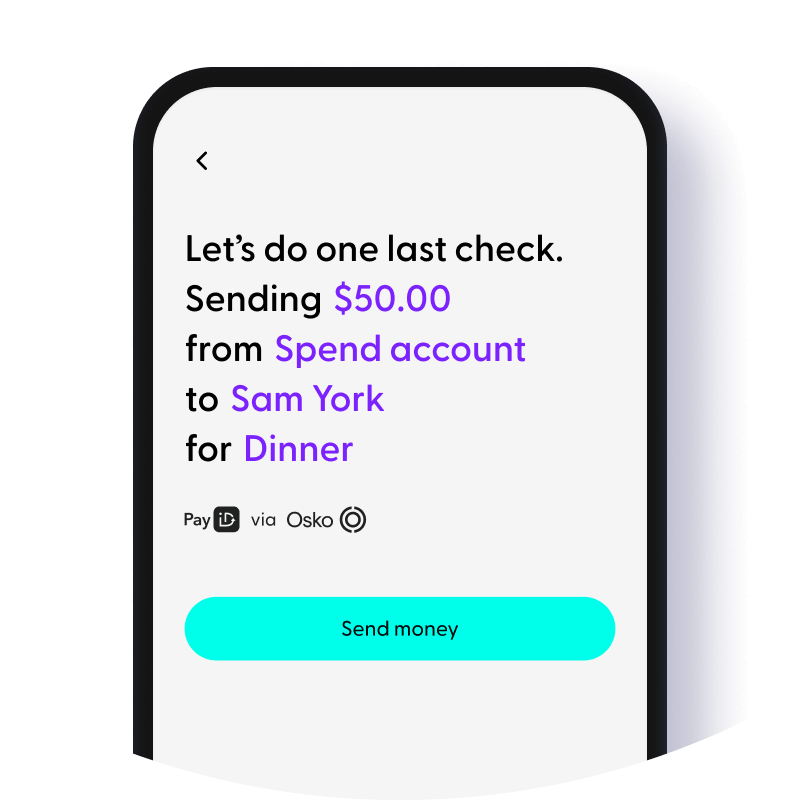

Start using your Shared account straight away

Join us

How to open a Shared account