Why a ubank account

What's in it for you

Our accounts

What makes our accounts different?

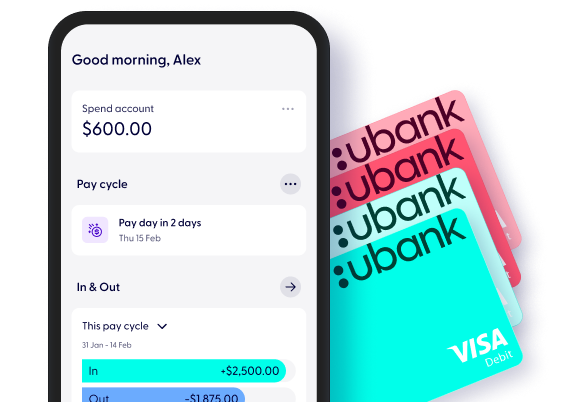

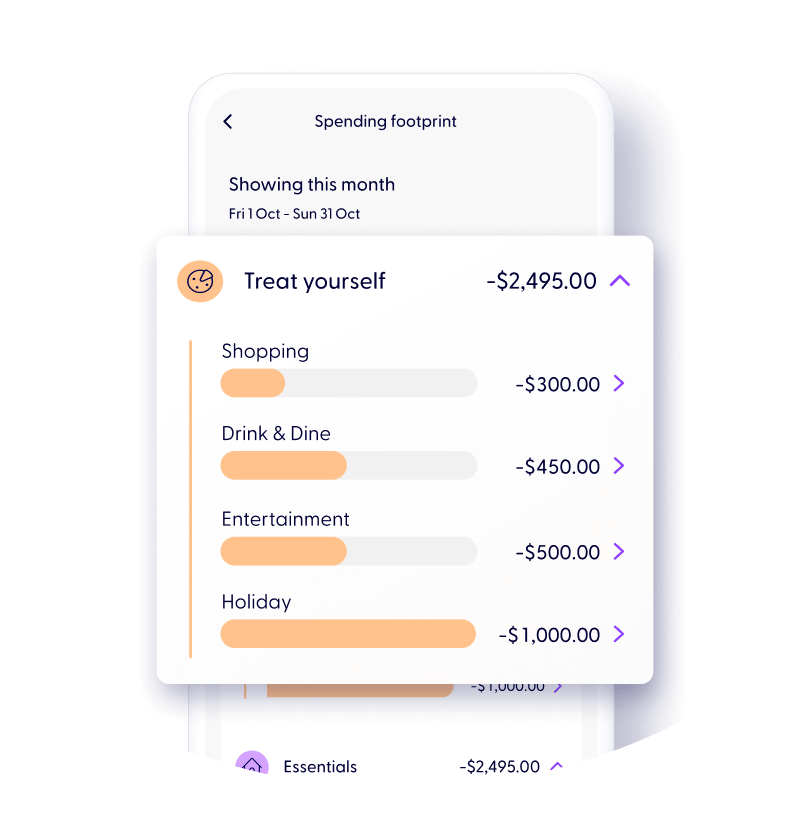

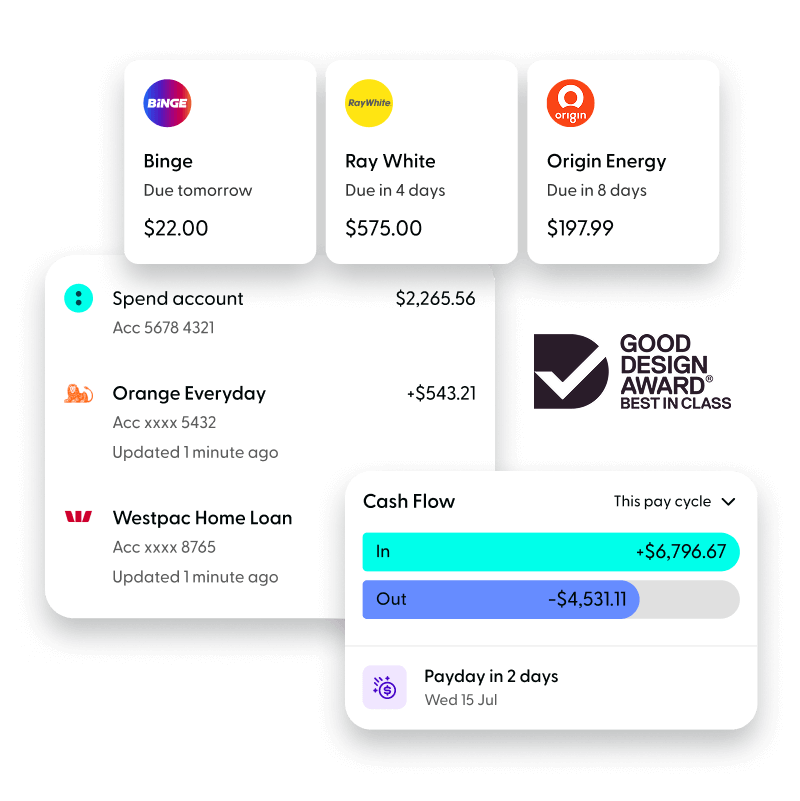

Spend account

Spending to feel good about

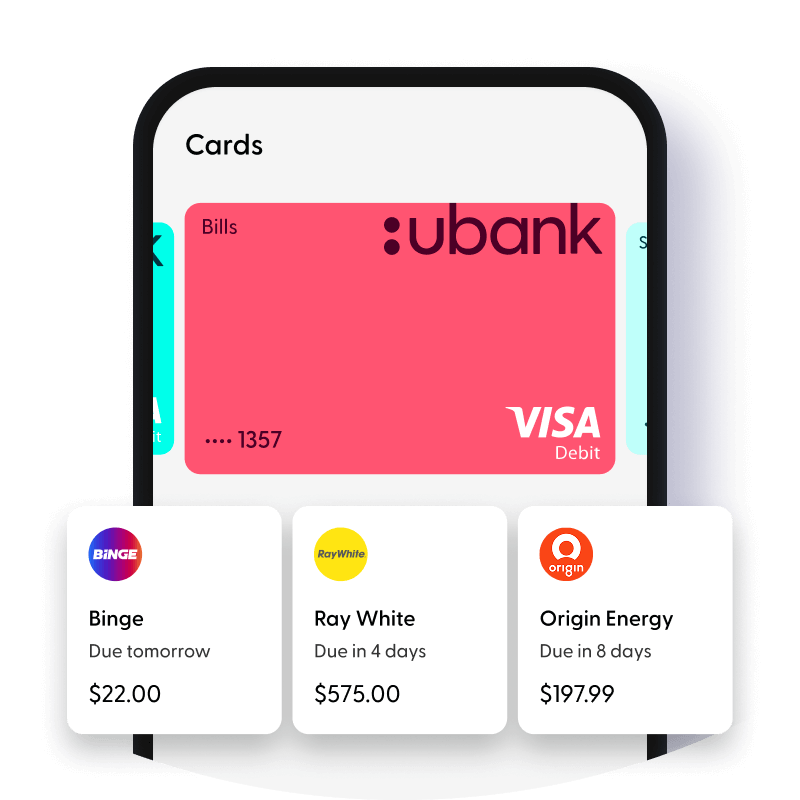

Bills account

Make bills more chill

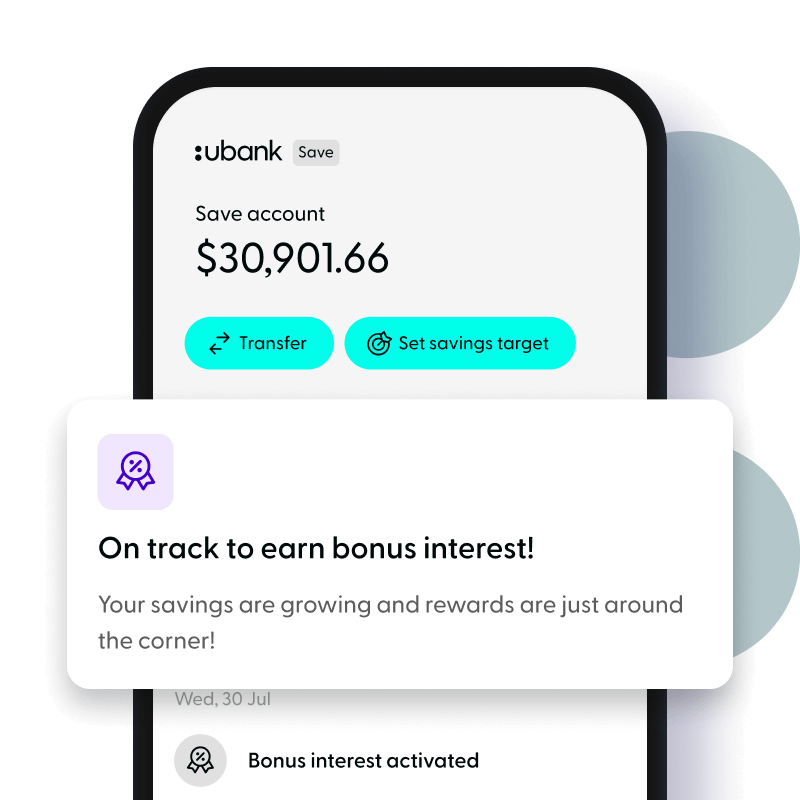

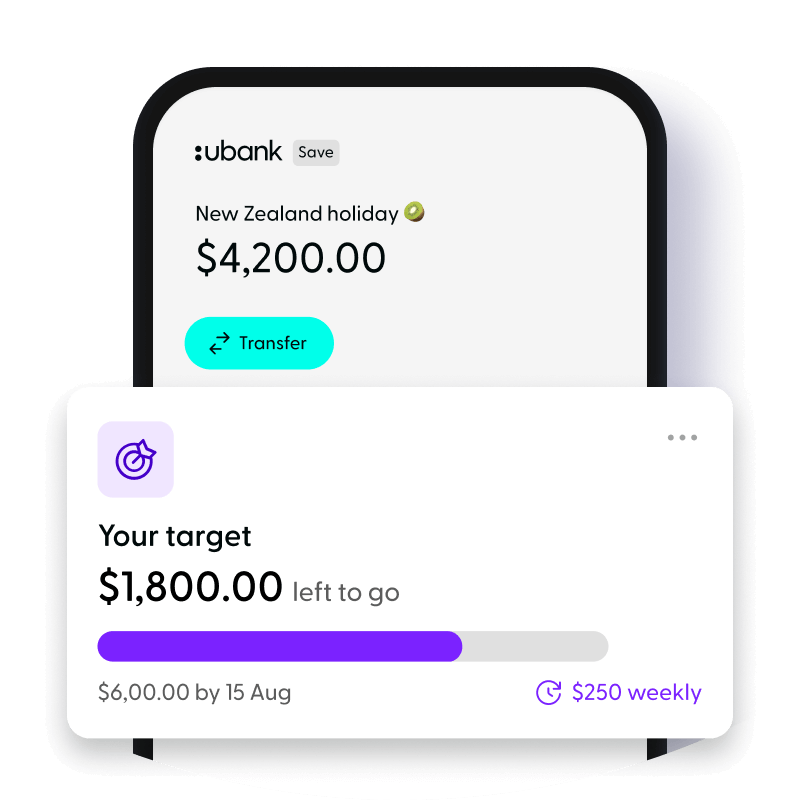

Save account

Become a more successful saver

Shared account

Mine. Yours. Ours.

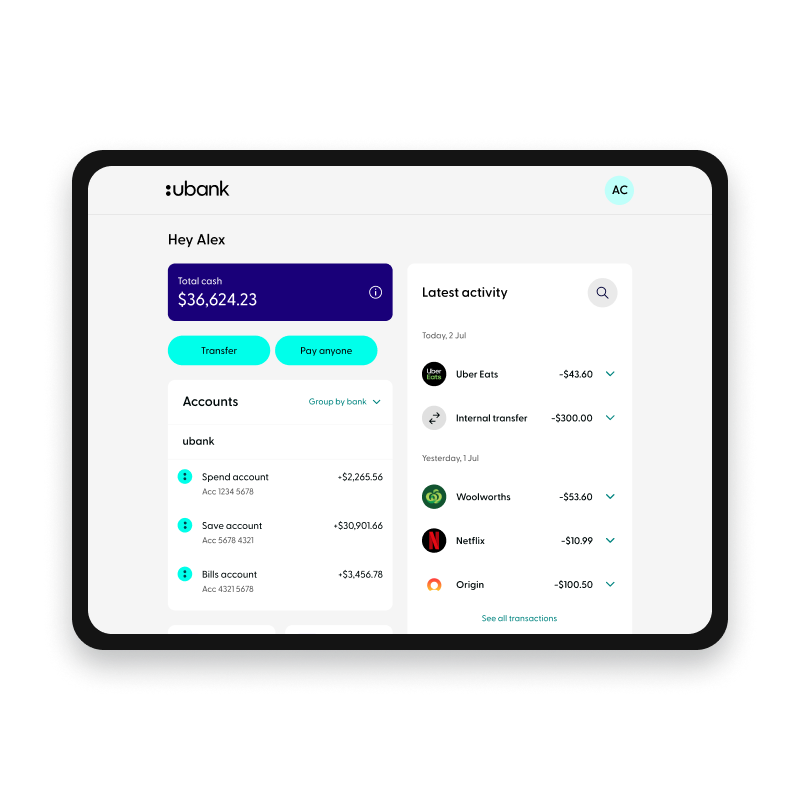

Ways of banking

Choose how you bank

Our feature packed app

Our online banking

Guides

Ways to max your money

Money Matters

Top passive income ideas

We all dream of working less and earning more, right? Passive incomes are a great way to boost your earnings with little to no ongoing extra effort.

Read more

Money Matters

How much of my income should I save?

Ever wondered how much you should be saving each paycheck? Figure out what percent of your income you should be putting away.

Read more

Money Matters

What is a joint bank account? And why would you need one?

Whether you're sharing an account with a partner, friend or family, a joint bank account is a great way to combine your finances.

Read more

Check out our guides

FAQs

Got some questions?

Need help?

Chat with our team