Offset accounts made simple

What is an offset account, really?

An offset account is a normal bank account linked to a home loan. You can use this account as you normally would – either to send and receive payments (e.g. Ubank Spend or Bills accounts), or to stash your savings (e.g. Ubank Save accounts).

Here’s the twist: instead of earning interest, the balance in an offset account reduces the amount of your home loan that gets charged interest. The bigger your offset balance, the less interest you’re charged.

Example

Home loan: $500k → Offset balance: $20k → Interest charged on: $480k

How does an offset account actually work?

Imagine a set of scales – your offset accounts on one side, and your home loan balance on the other. The balance of your savings in an offset account literally offsets the balance of your home loan, and rewards you because you’re only charged interest on the difference.

As your offset balance grows, the interest you are charged will decrease thanks to this benefit. That means more of each repayment goes towards paying off the principal of your loan.

The result? You could pay off your home loan faster, and save yourself thousands of dollars in interest along the way with offsets. Meanwhile, you still have access to all your money for everyday spending and other purchases – but while it’s parked in your offset, it’s always working to save you money.

| Without offset account | With offset account | With multiple offset accounts | |

| Loan | $500k | $500k | $500k |

| Offset balance | $0 | $20k | Acc. 1: $20k Acc. 2: $50k Acc. 3: $10k |

| Example loan Interest rate | 5% | 5% | 5% |

| Interest charged against | $500k | $480k | $420k |

| Interest paid (monthly) | $2083.3 | $2000 | $1,750 |

| Interest saved (monthly) | $0 | $83.3 | $333.3 |

The benefits of offsets

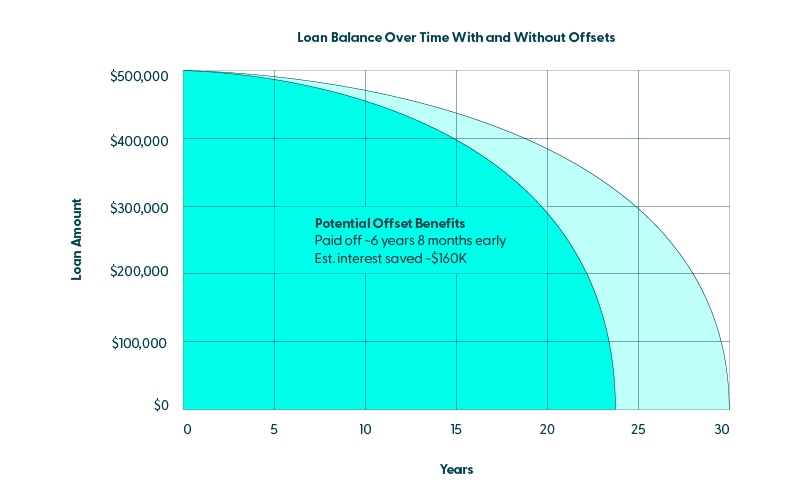

Now that you know how offsets work, let’s dive into one of the biggest benefits: time.

Your offsets don’t change your repayments, but they do change where they go. When you’re charged less interest, more of your repayment can go toward your principal. That means you can start to get ahead of schedule on your loan and knock it over faster.

For instance, if you have a $500k home loan and consistently keep $20k in an offset, you could shave years off your loan term. That’s your money quietly pulling overtime, every single day. If you keep adding to that balance you can pay off your loan and own your own property even faster.

And because this is Ubank, you can even set up multiple offset accounts to keep your goals in convenient buckets – like holidays, renos, or future savings for your family – all while getting ahead on your home loan and building your wealth.

Offset accounts Vs. Savings accounts

At Ubank you can turn any Spend, Save, or Bills account into an offset account, as long as all the account holders are also on the loan. But offsets don’t earn interest on savings. So how does it compare to a conventional high interest savings account?

When you earn interest on savings, you usually earn a variable rate on your balance. In contrast, with offsets, you save yourself from paying a variable rate on that balance. The benefit is similar, but home loan interest rates are typically higher than savings interest rates, making offsets more valuable.

The kicker is that the savings from offset benefits are tax free, while interest earnings from savings will generally be taxed as part of your income at the end of each financial year. That means that, depending on your circumstances, offset accounts may contribute more to your wealth than high interest savings accounts.

Want to dive deeper into how offsets stack up against redraw? We’ve broken it down here.

How to get the most out of your offset account?

- Maximise the money in your offset accounts – Interest on home loans is calculated daily. When interest is calculated, your offset account balances will be subtracted from your loan balance to find the effective loan balance on which you’ll be charged interest.

- Link your existing Ubank accounts as offsets – No need to set up new accounts. Keep doing money the way you like, and have all of your eligible Ubank accounts offsetting your home loan.

- Pay bills on the last day – The longer money stays in your offset accounts, the longer it’s offsetting your home loan. Don’t pay for things earlier than you need to, and reap the rewards.

- Get paid into an offset – The earlier your money hits the offset, the more money it can save you. Even a few days can shave off interest!

- Link your everyday spending account as an offset – Ubank lets you turn eligible Spend accounts into offsets. Link the account you use for daily transactions to your home loan, and you’ll be rewarded on your spending money too.

- Keep your savings in your offsets – Instead of parking money in a separate savings account, you can put it in your offset so every dollar helps cut down your interest.

The long and short of it is this: the more you keep in your offsets, and the longer it stays there, the more interest you can save.

Is an offset account right for me?

Offset accounts can be powerful, but they’re not for everyone. If you don’t tend to keep much cash in your account, the benefits may be smaller.

Here are two things to consider before opting for a Ubank Flex home loan with offsets:

Made for savers – The value of offsets comes from your savings. If you don’t have much of a safety buffer after buying, offsets may not be worth the cost of the annual fee.

Access to funds – Offsets allow you to access money the same way you do with a normal bank account. If you’re someone who likes to spend what you have, this benefit can become a disadvantage if you’re not careful. In that case, a redraw facility or lower-rate loan might suit better.

At the end of the day, an offset can suit anyone who wants to cut interest, keep flexibility, and build good financial habits.

Check out our FAQs on offset account.

If you have any questions, get in touch with our lending specialists on 02 9058 7404. We’re available Monday to Friday, 9am–7:30pm, and Saturday & Sunday, 9am–5:30pm (Sydney time).