Why our Spend account

What's in it for you

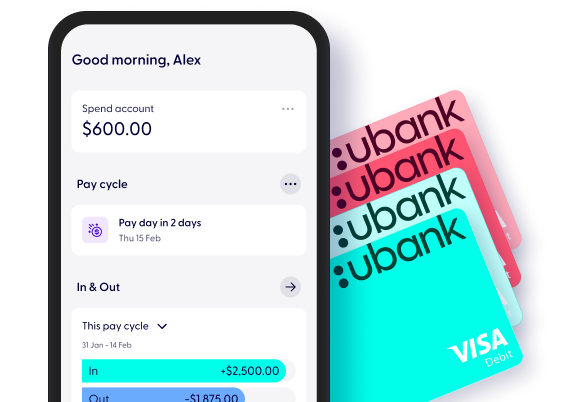

Start spending straightaway

Rates and fees

Everyday banking without the fees

Why ubank

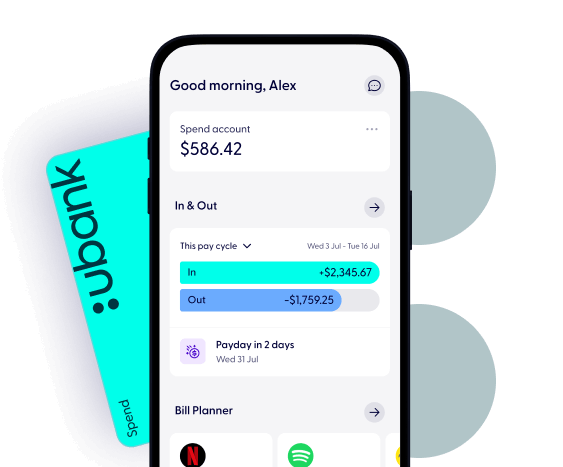

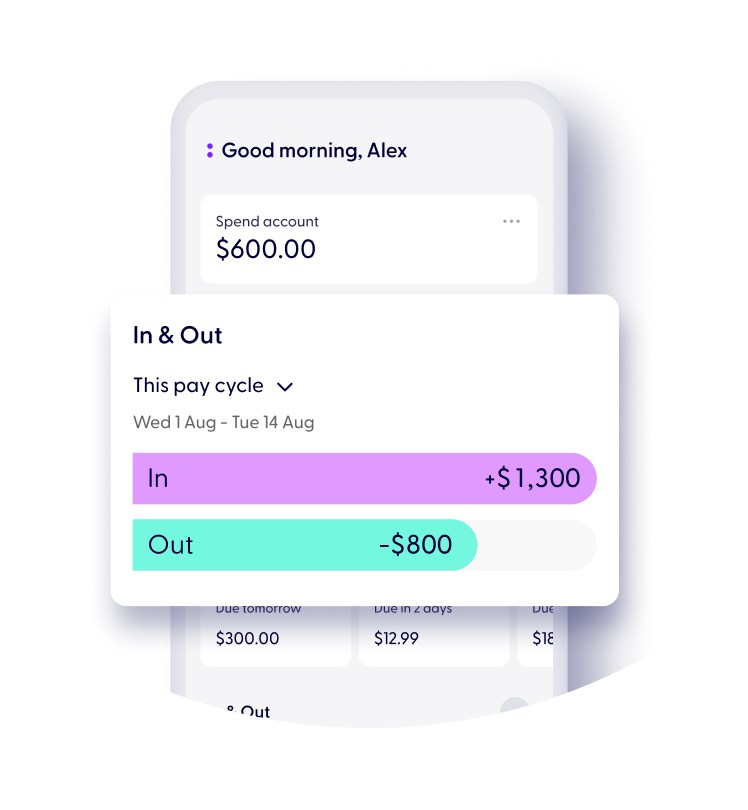

See your money clearly

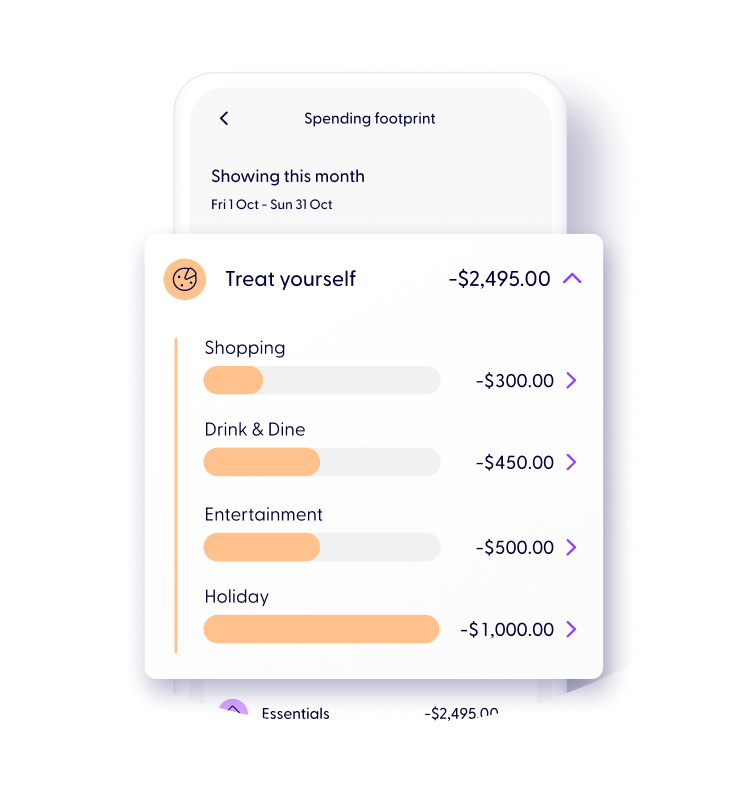

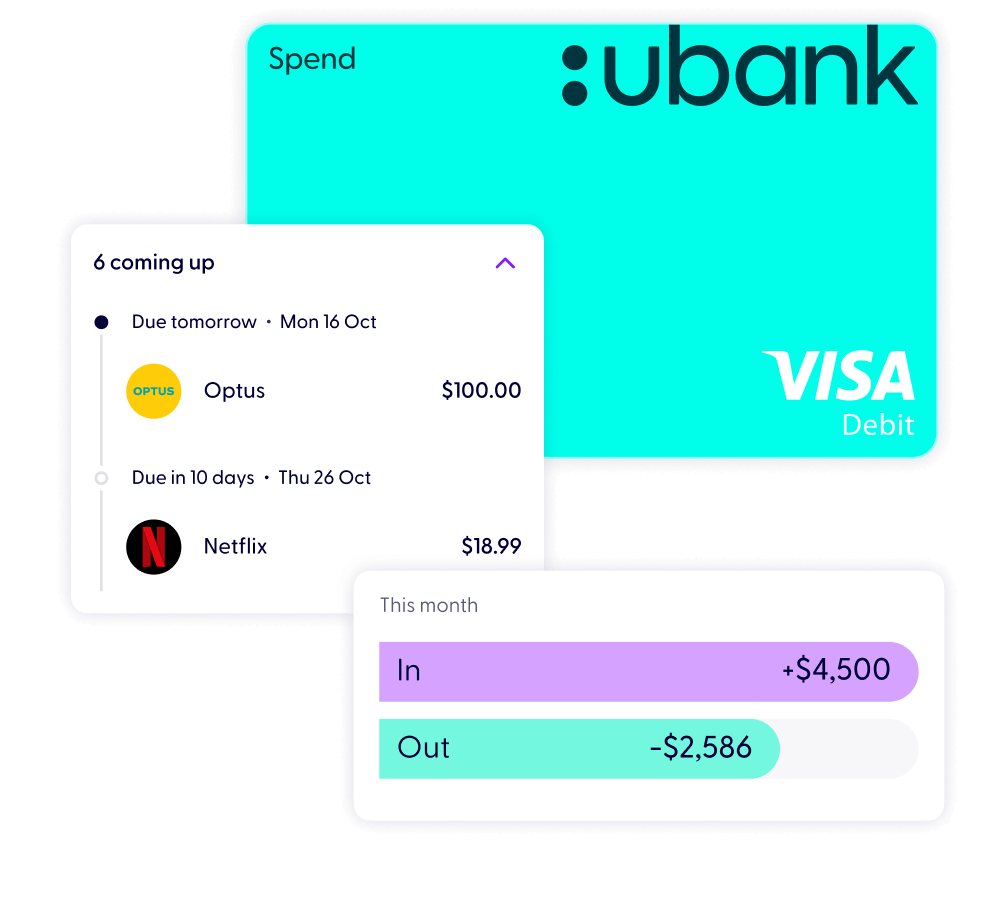

Spending Footprint helps you retrace your spend

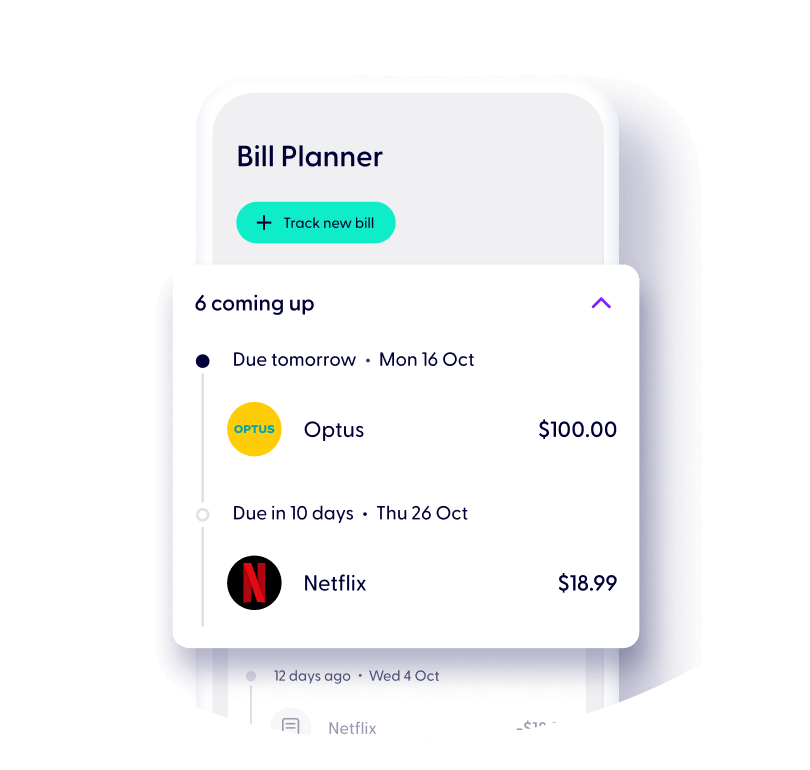

Plan for your expenses by tracking your bills in the Bill Planner

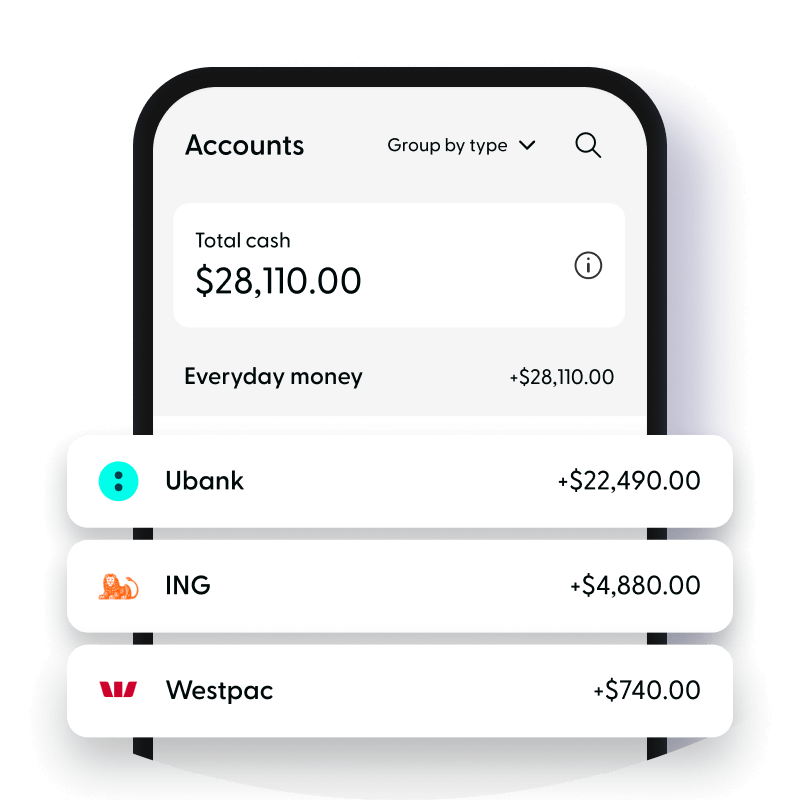

It’s okay to see other banks

Know your money inside and out

Plus get 2 more accounts, a Save and a Bills

Join us