Why our Save account

What's in it for you

Our great savings interest rate

What makes up our total interest rate

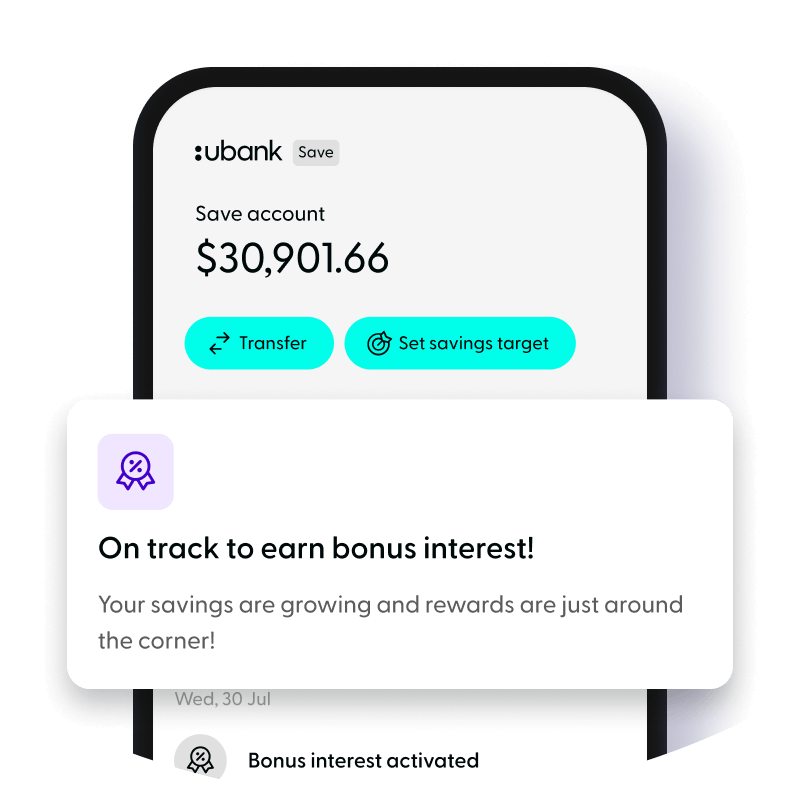

Want bonus interest on all your Save accounts?

Why ubank

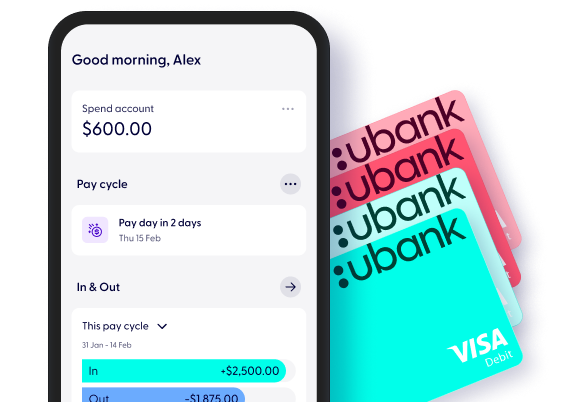

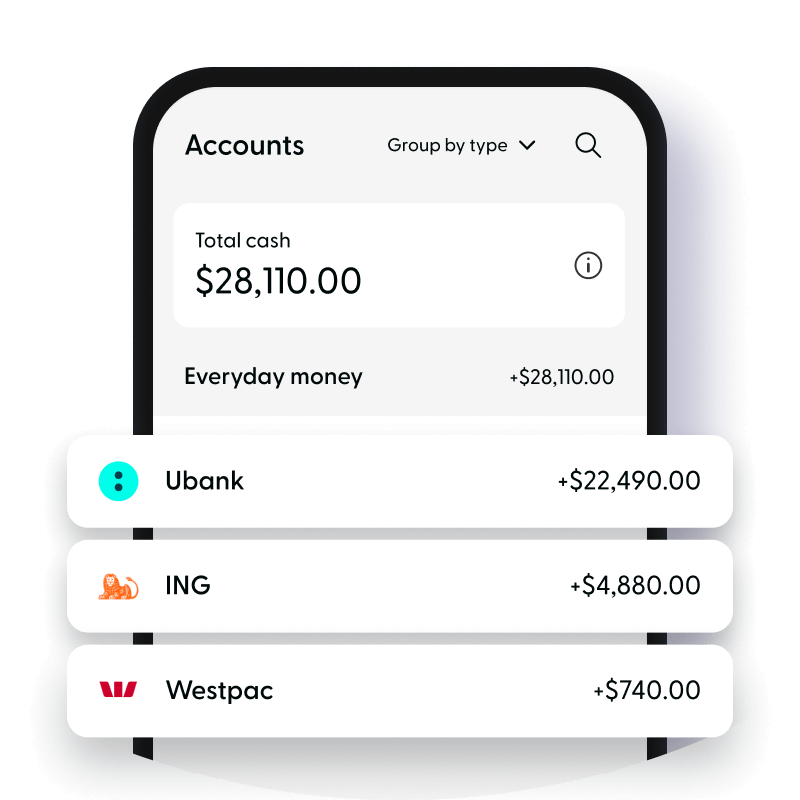

See your money clearly

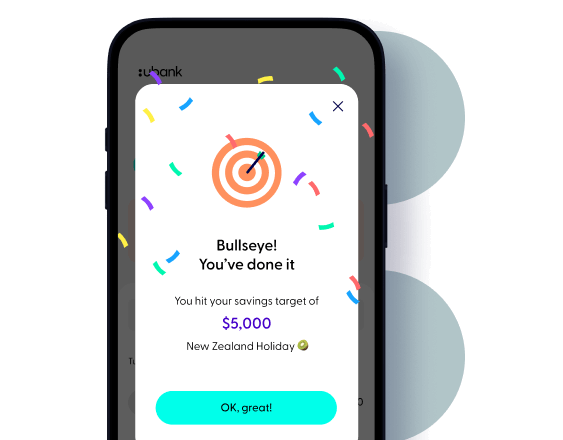

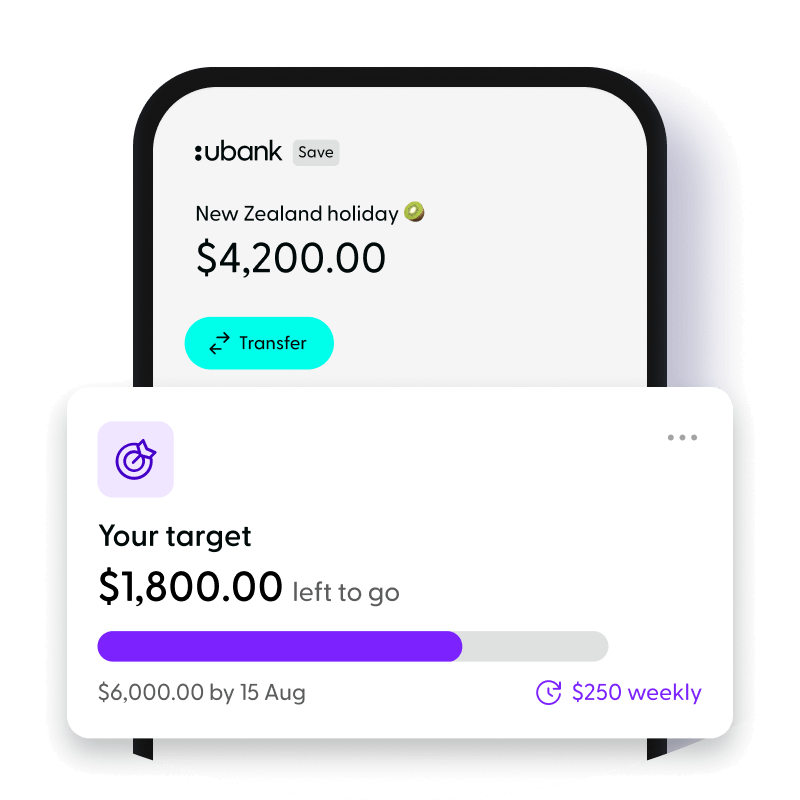

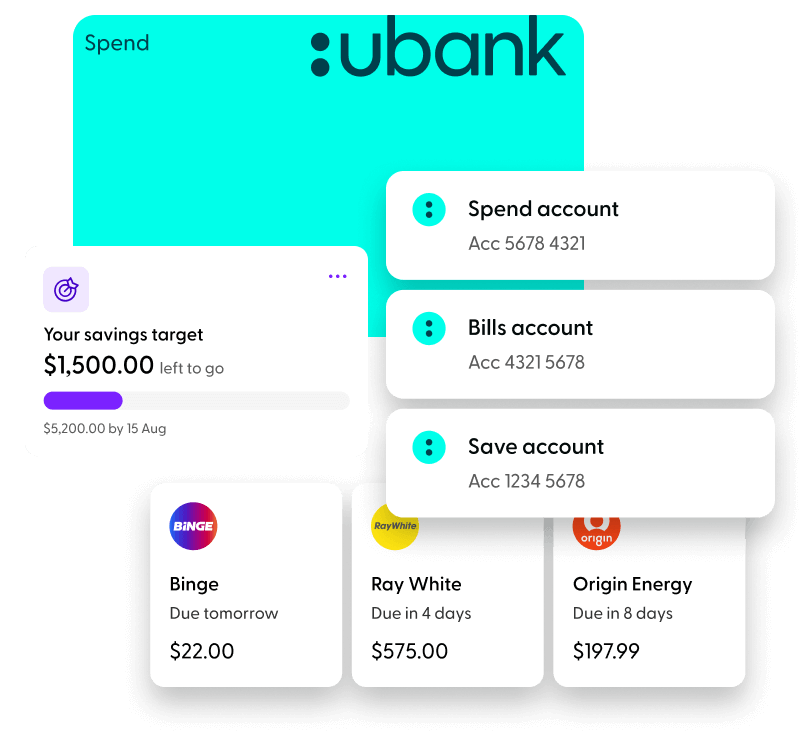

Hit all your savings targets, right on the money

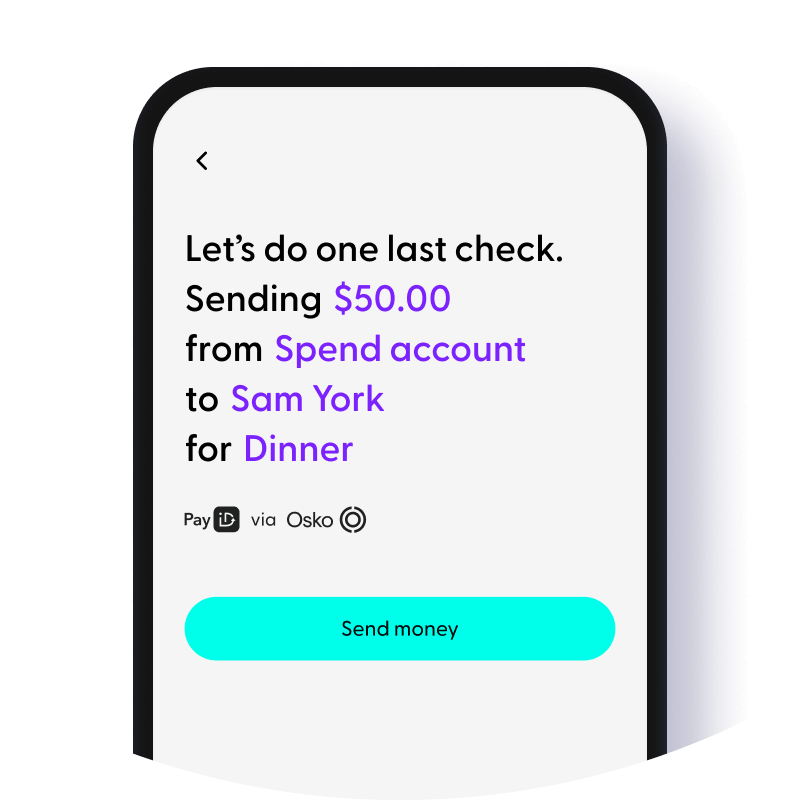

Almost instant access to your savings when you need it

It’s okay to see other banks

Plus get 2 more accounts, a Spend and a Bills

Join us