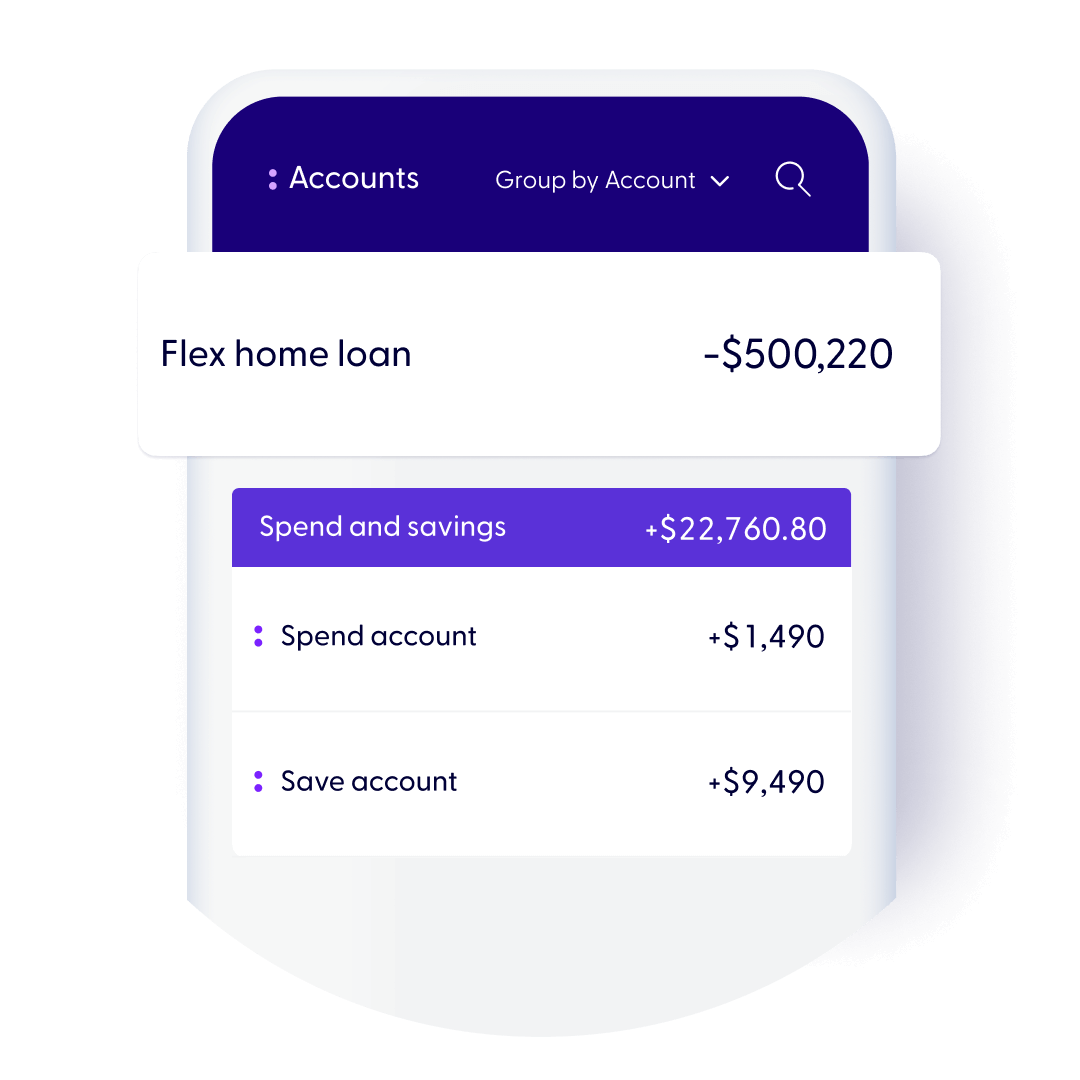

Check your loan details

Stay on top of your home loan

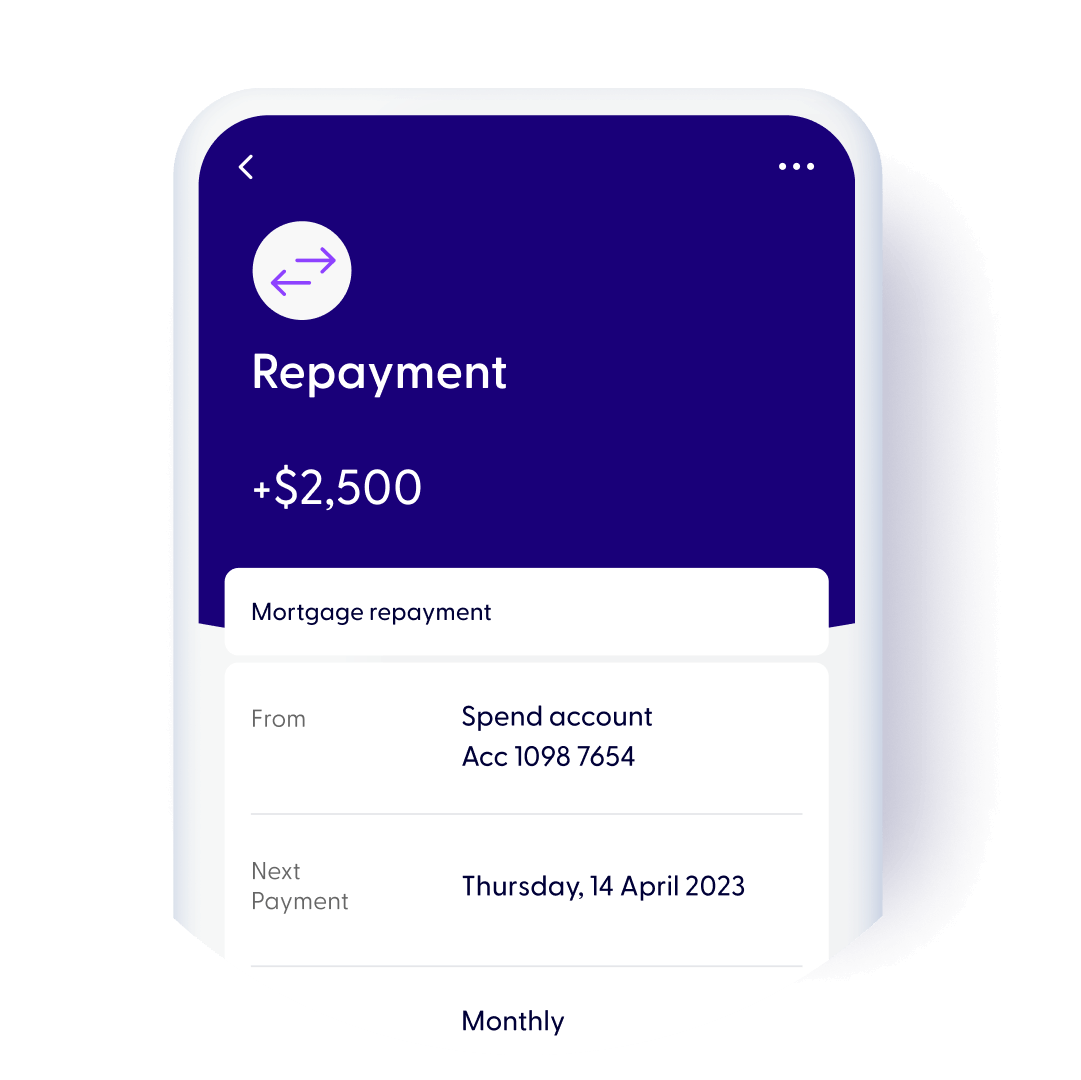

Change repayments

Take control of your repayments

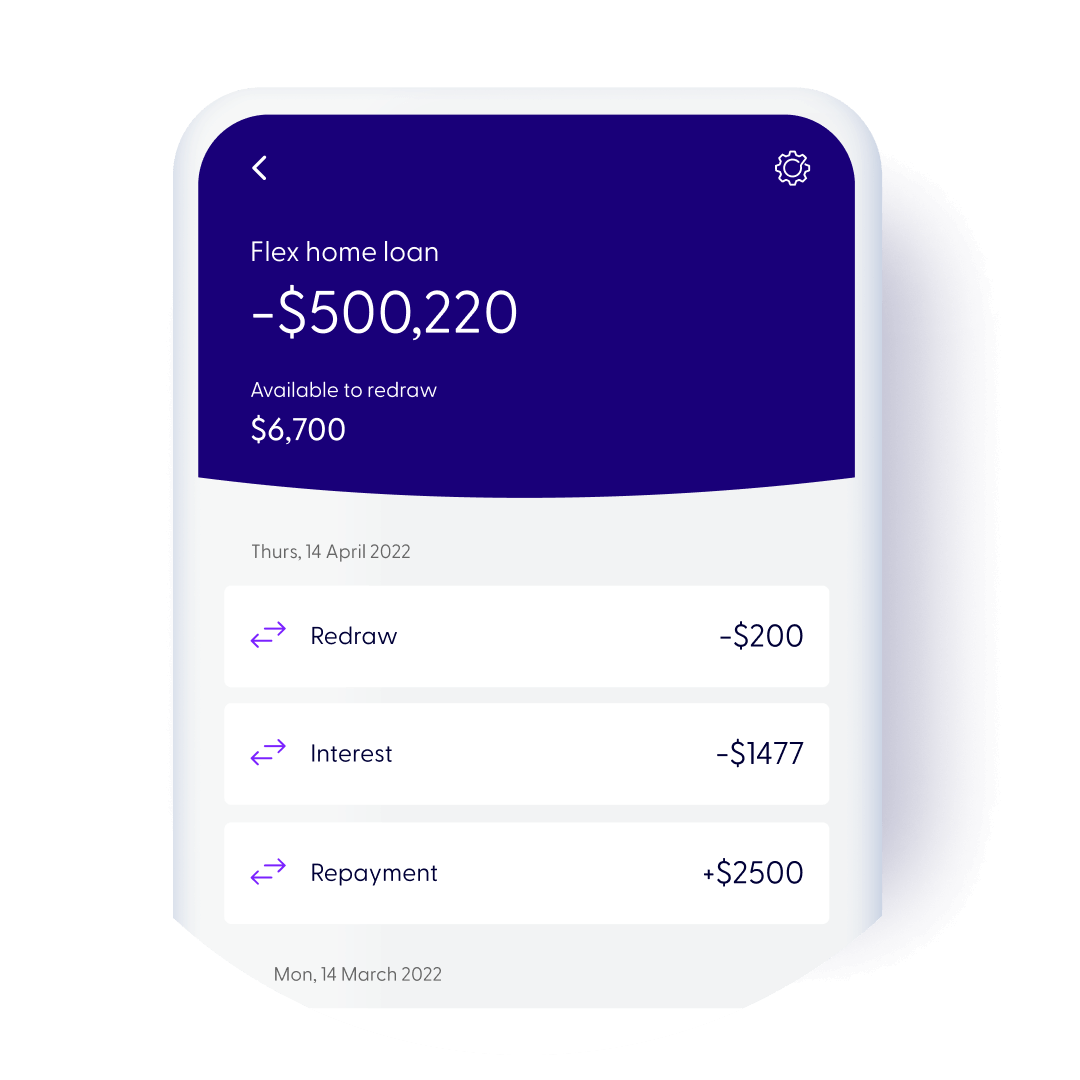

Make and redraw additional payments

Pay off your loan faster

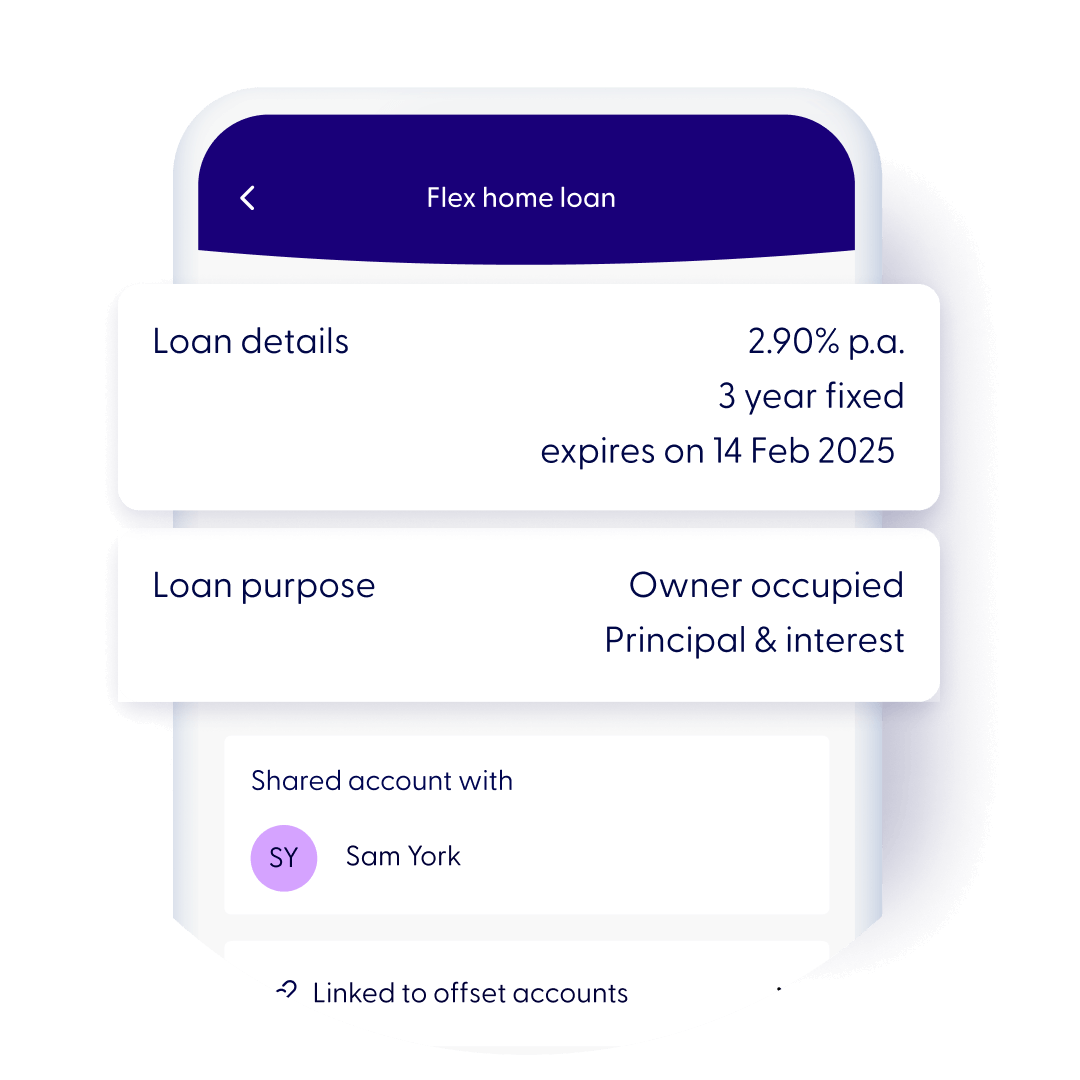

Managing offset accounts

Lower the interest on your loan

Update loan type or loan amount

Change your loan to suit you

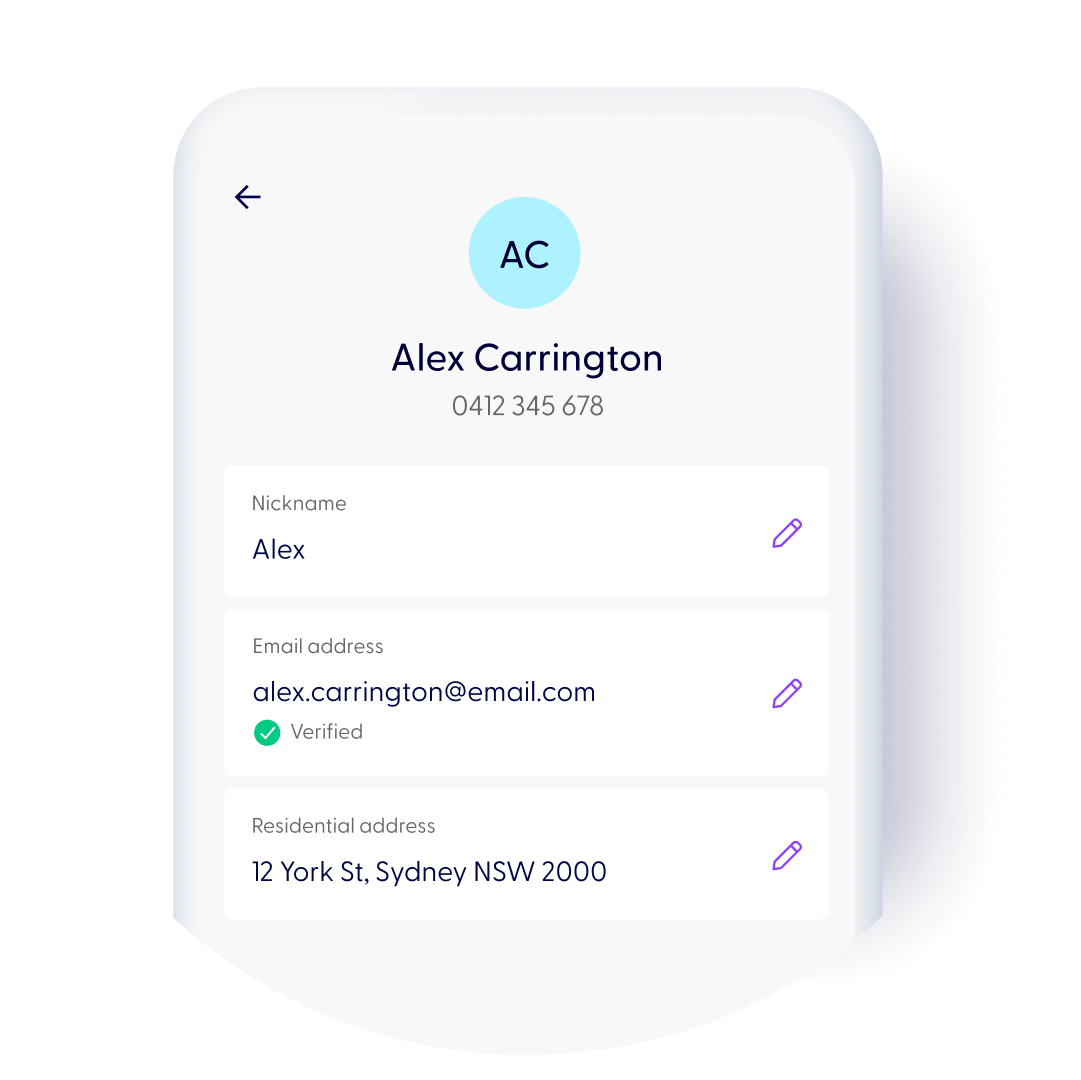

Change details

Need to update your personal details?

Useful links and tools

Make changes with confidence