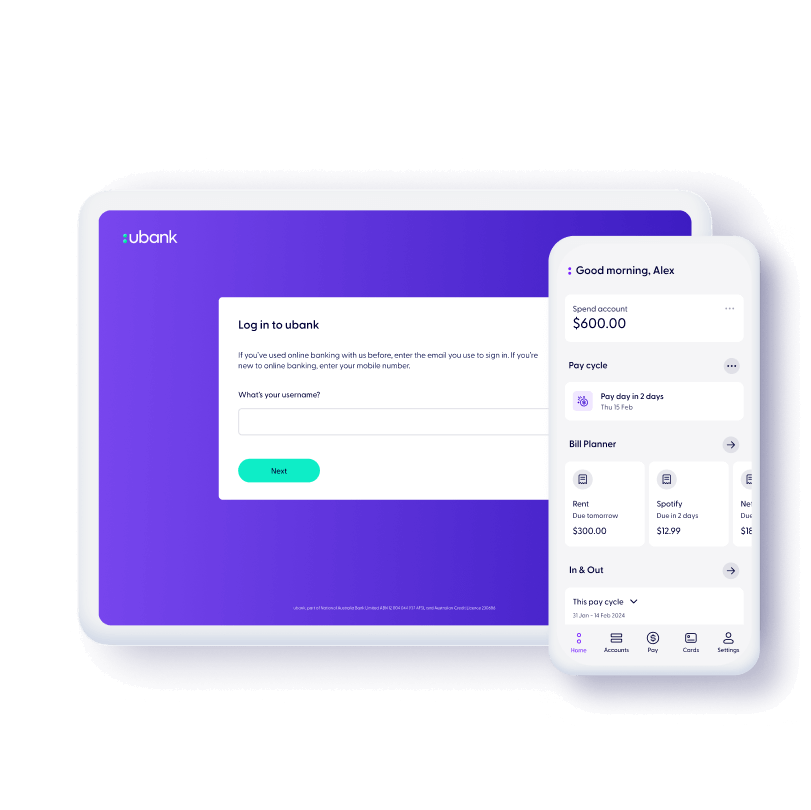

Why our app

See your money more clearly

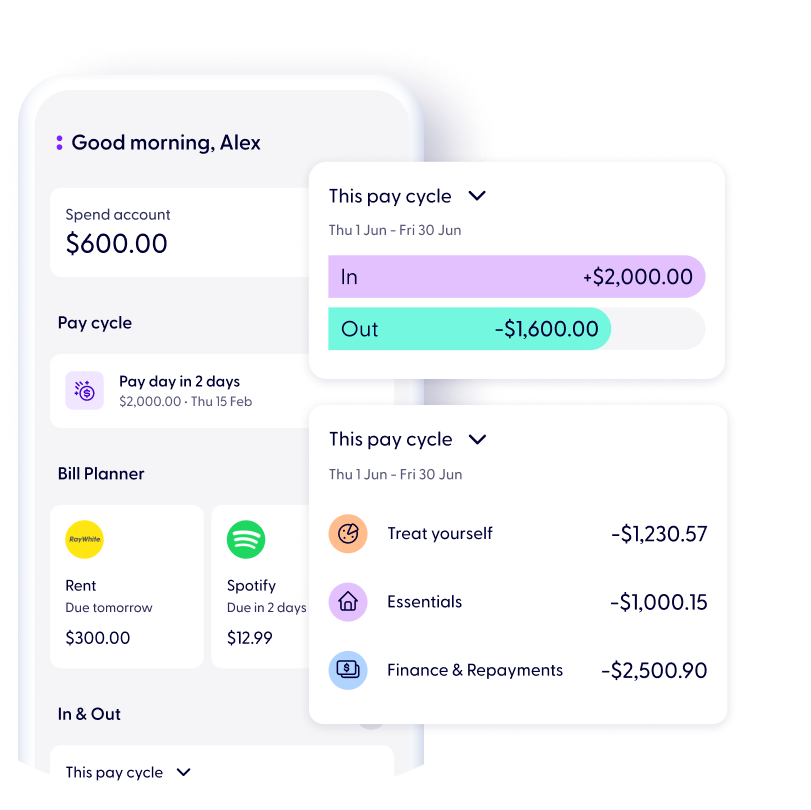

It all starts with your payday!

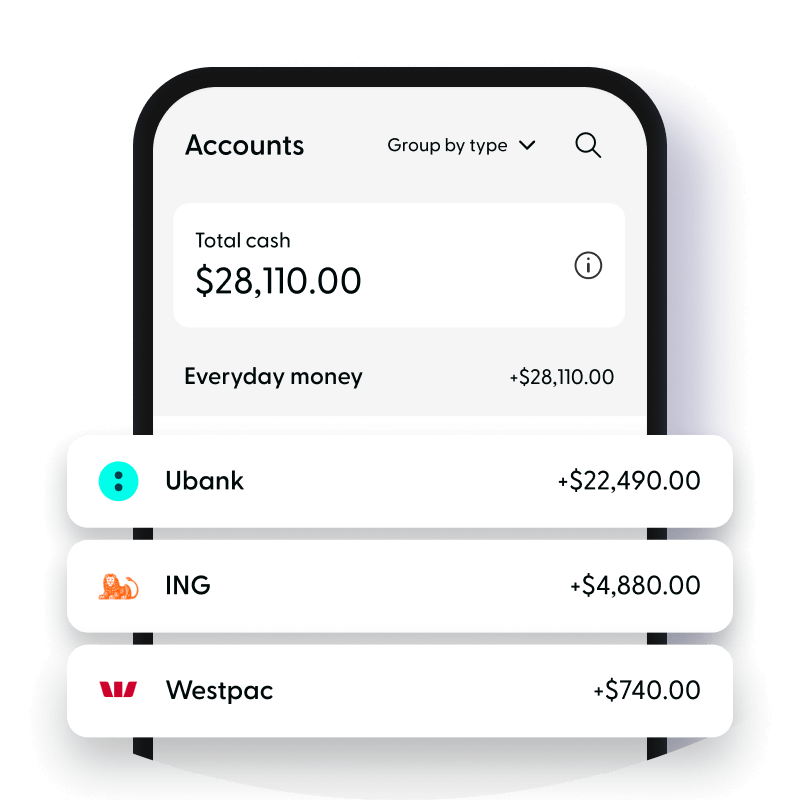

Connect your other accounts

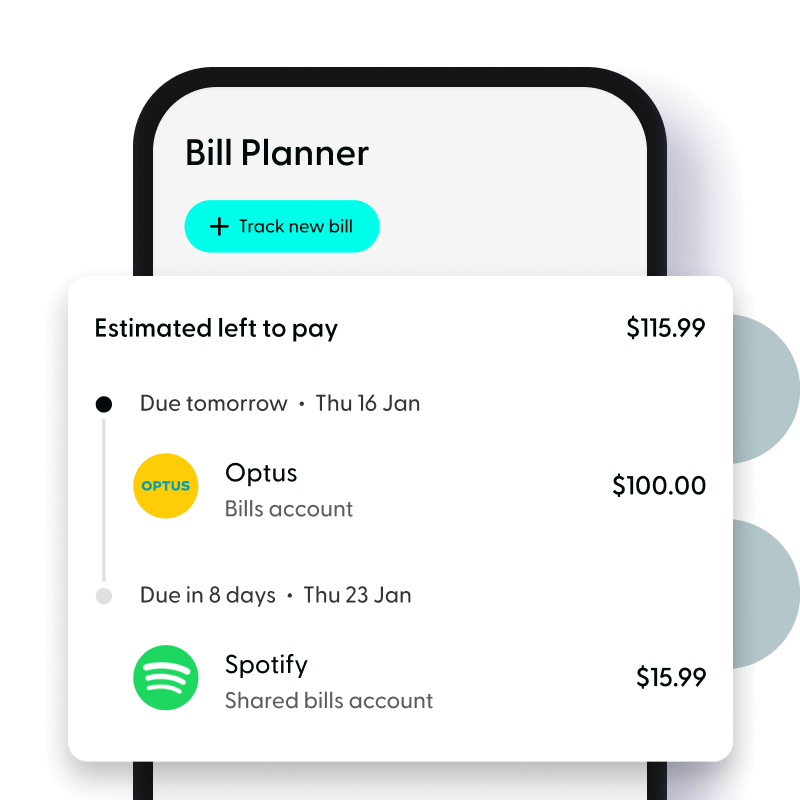

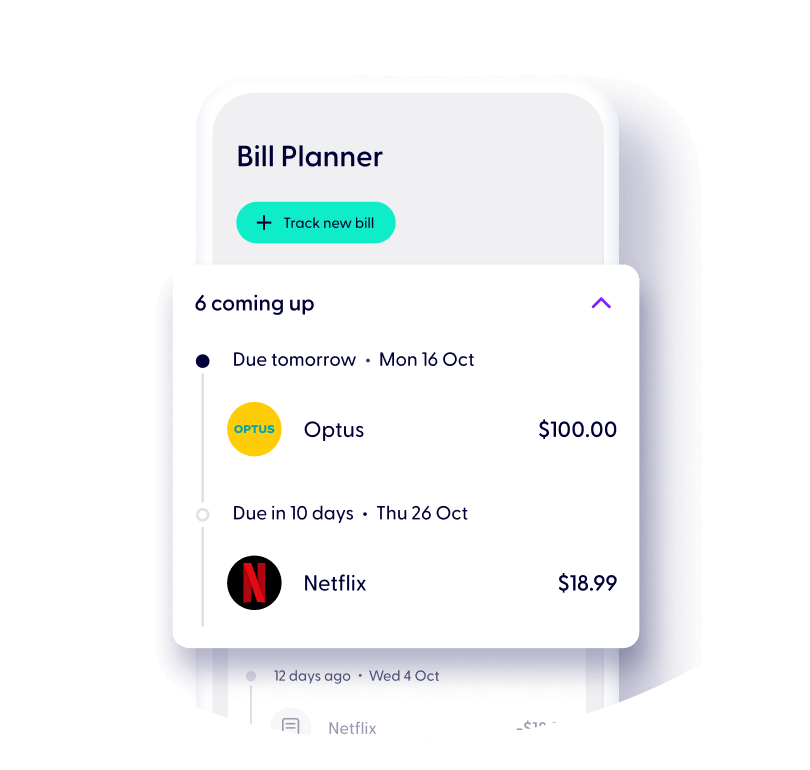

Plan for your bills with Bill Planner

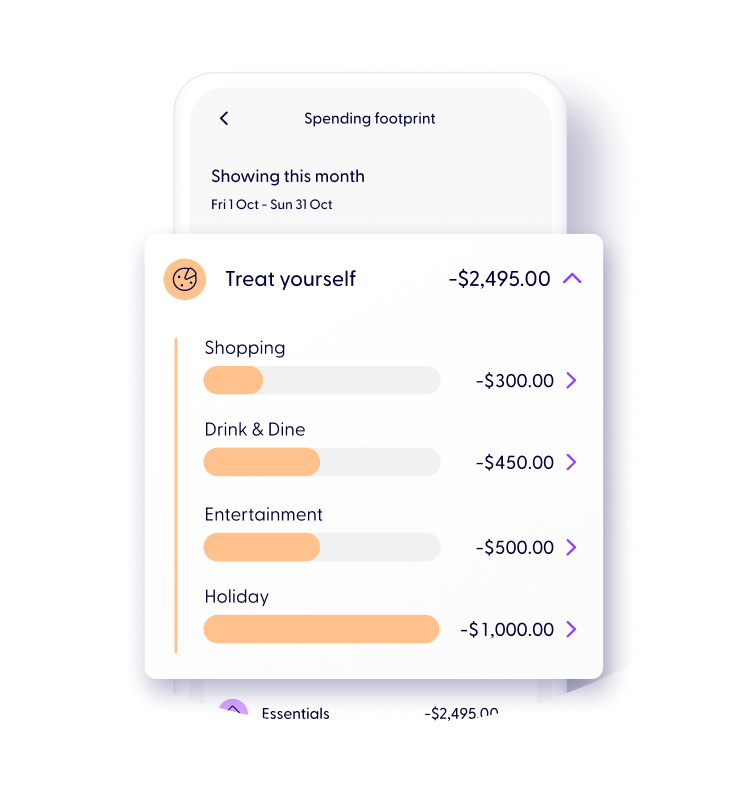

Track your Spending Footprint

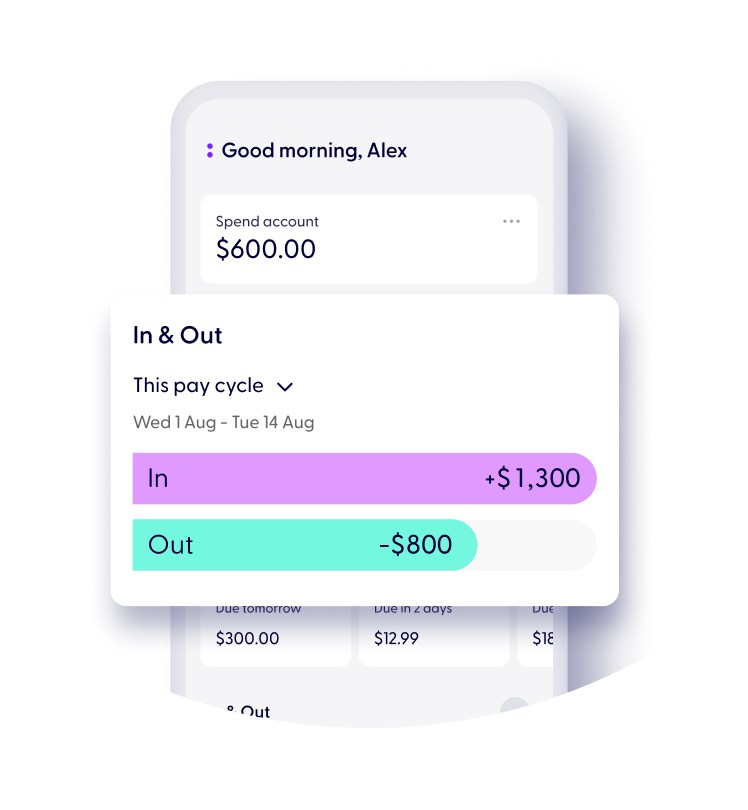

Get ahead with In & Out

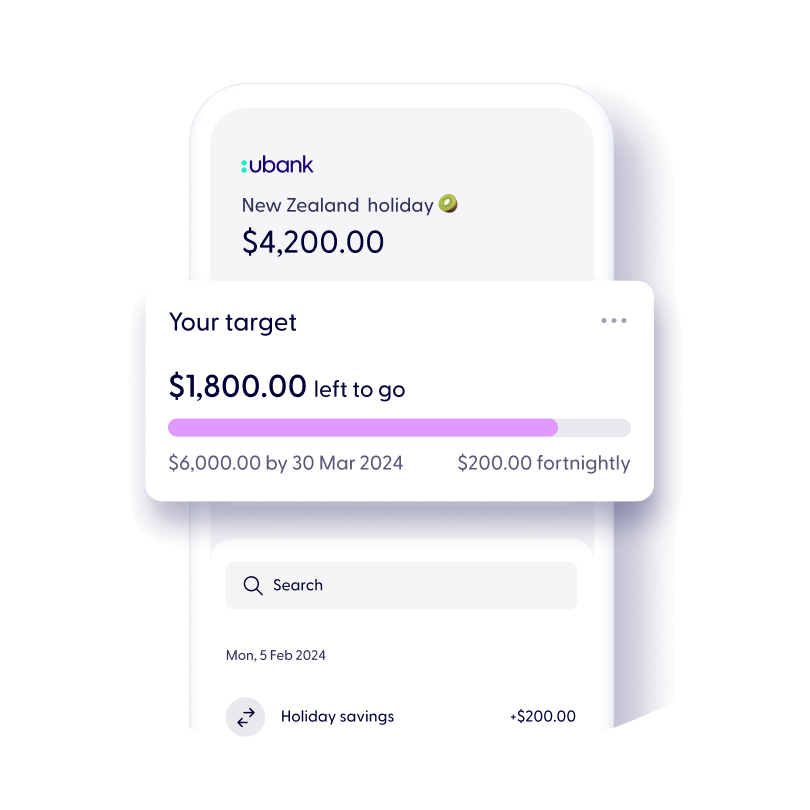

Hit your goals with Savings Targets

App features

Other handy features

Join us

How to get started with ubank