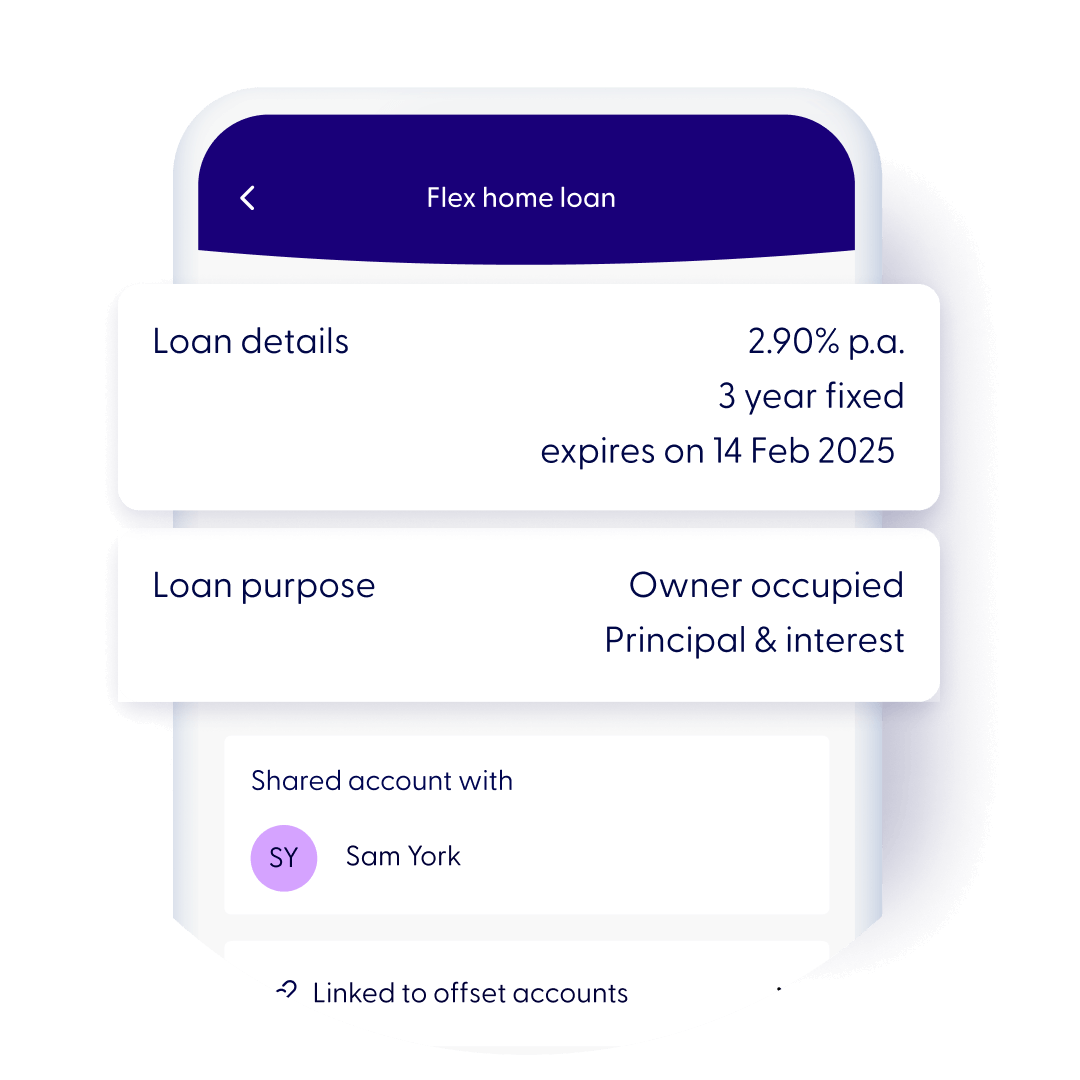

Check your loan details

Stay on top of your home loan

Once you’ve settled your loan, you can check out your loan details including your next minimum repayment and statements within our app.

Keep scrolling if you want to find out how to make any changes to your Neat and Flex home loans like changing repayments, making or redrawing additional payments or updating your personal details.

Do you have a UHomeLoan? Here’s how to manage your UHomeLoan.

Need to make changes to your home loan?

We’re happy to help. To make changes to your loan such as increase your loan amount, add or remove a borrower, extend your interest-only term or convert to interest-only payments, change the property your loan is secured by or discharge your loan, leave your details, and we’ll call you back.

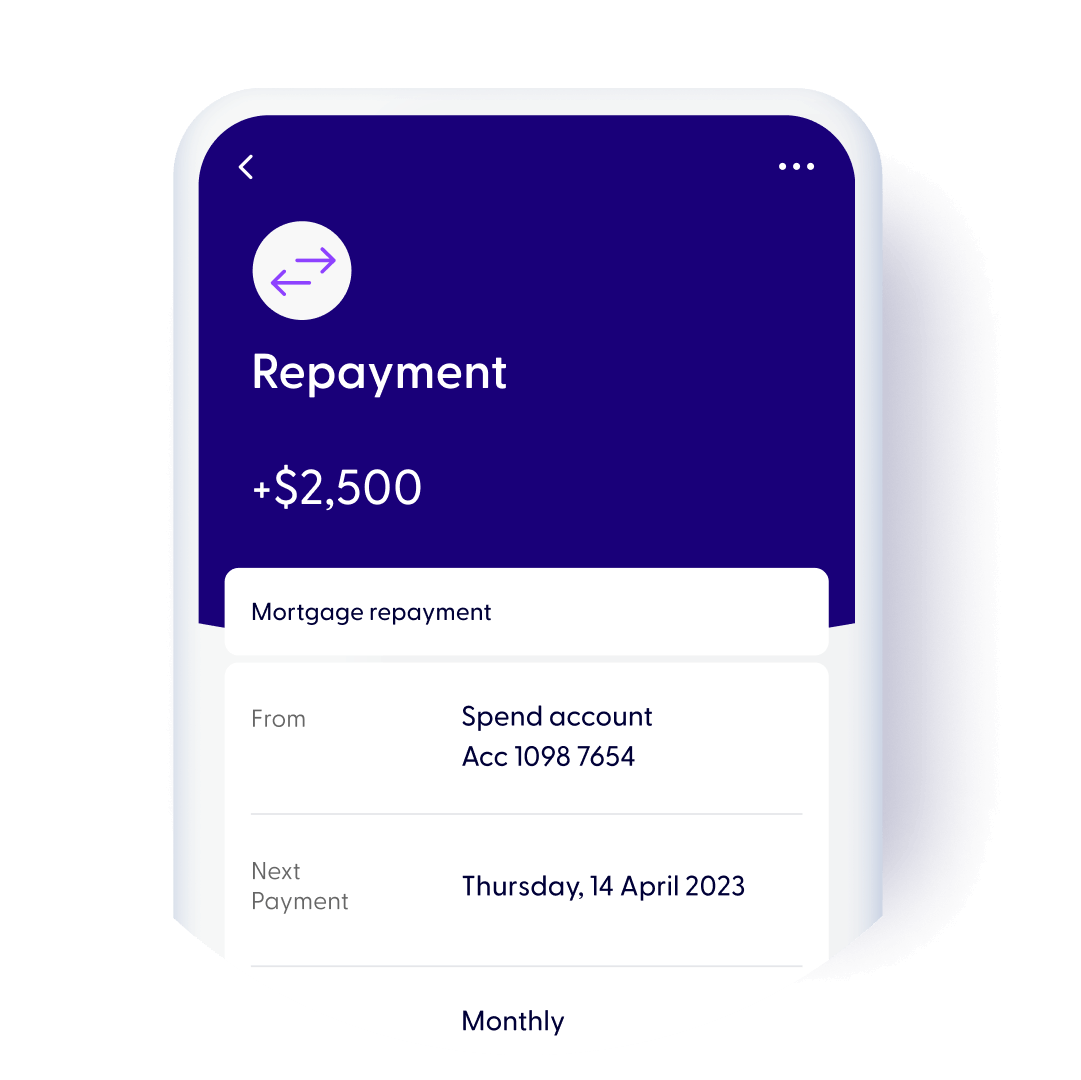

Change repayments

Take control of your repayments

You should be able to choose how and when you pay back your home loan – it’s your money after all.

You have total control over:

which Spend or Bills account we automatically take your repayments from

your repayment frequency, whether it’s weekly, fortnightly or monthly

the day of the month you make your monthly repayments if you’re on a principal and interest (P&I) loan.

To make any changes to your repayments, give us a call on 13 30 80.

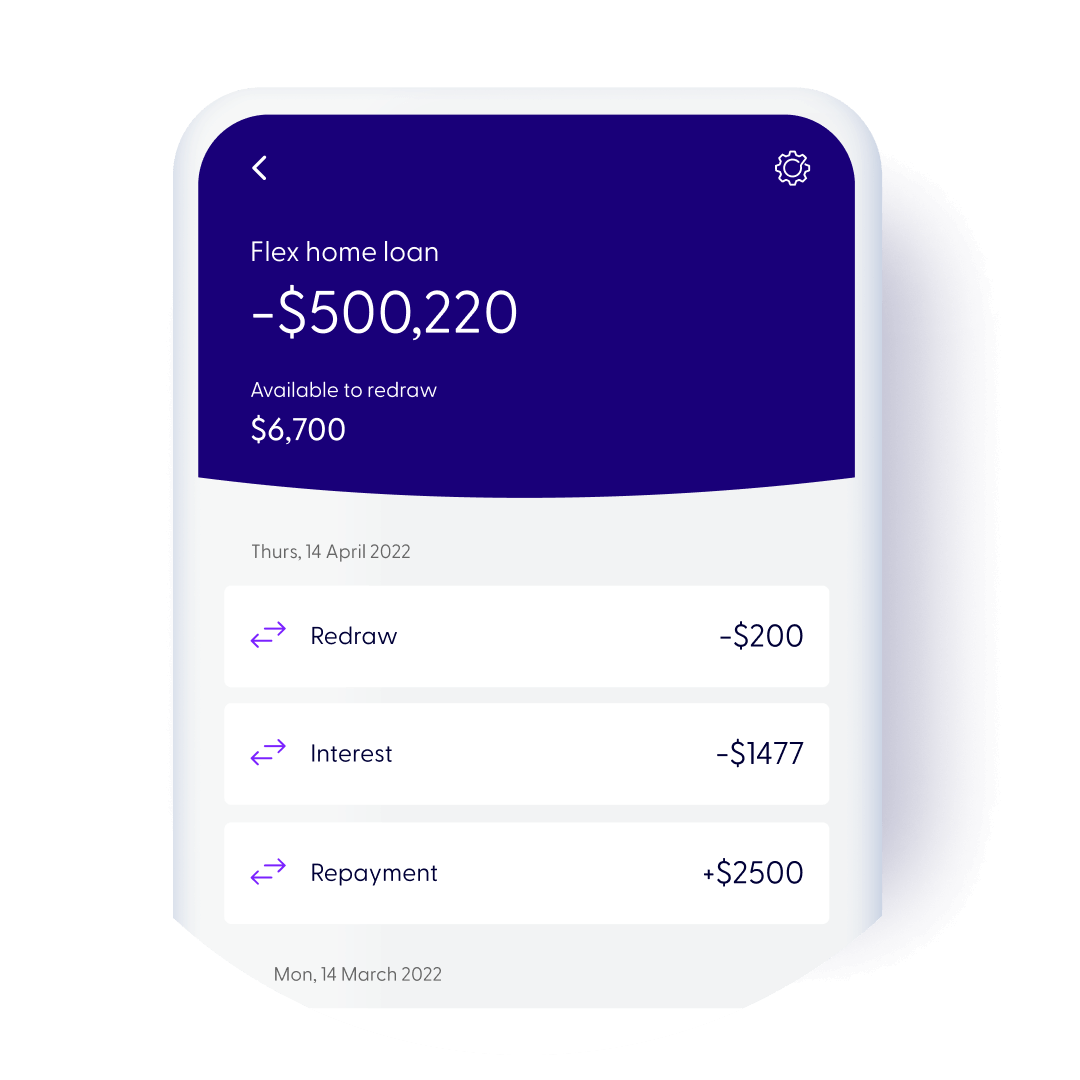

Make and redraw additional payments

Pay off your loan faster

With our Neat and Flex variable loans, you can make unlimited additional payments at no extra cost.

If you’re on an Flex fixed loan, you’ll be able to make additional payments up to $20K during your fixed term.

Whenever you like, you can redraw your additional payments by using our app to transfer the money to any of your Spend, Bills or Save accounts.

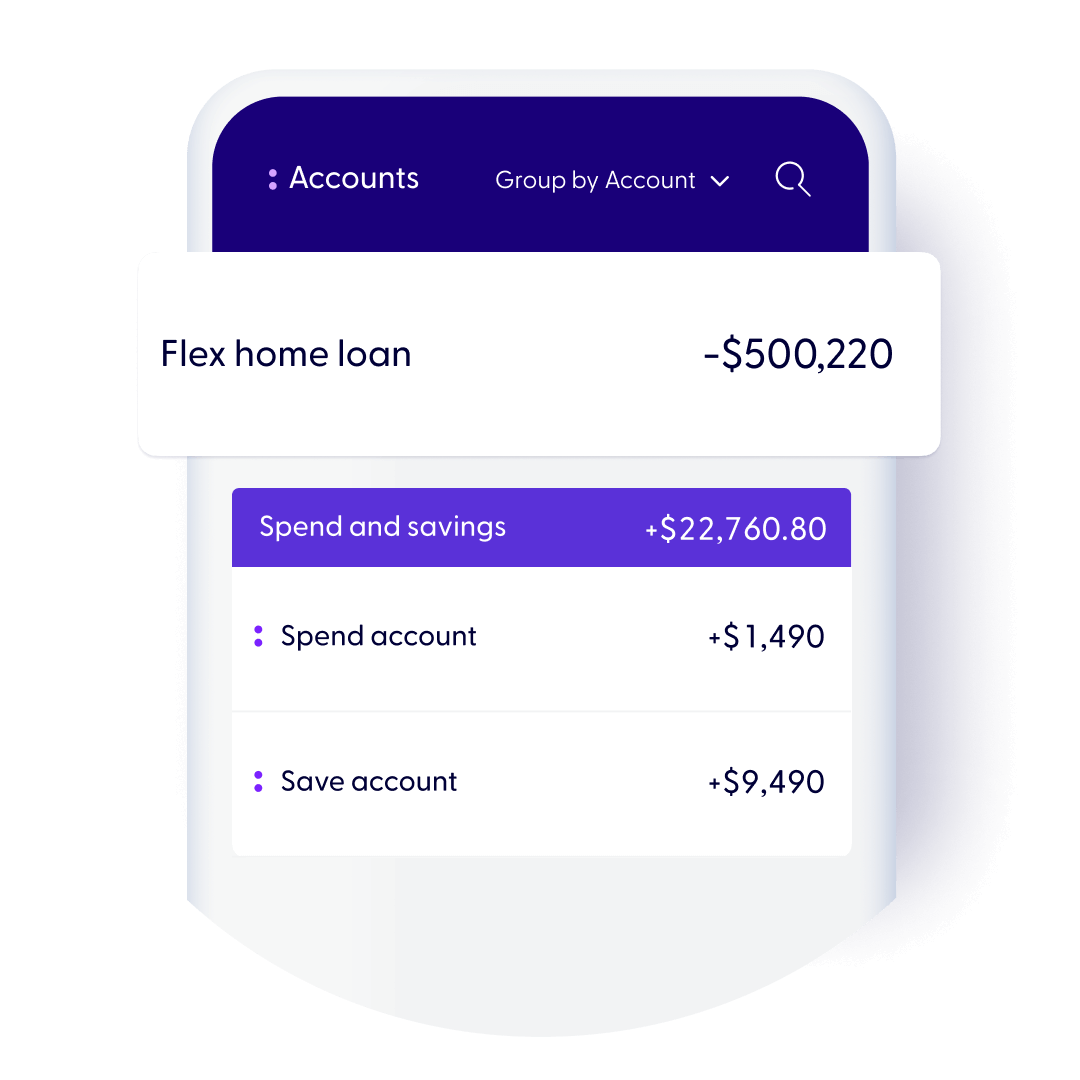

Managing offset accounts

Lower the interest on your loan

If you have a Flex variable loan, you can link multiple Spend, Bills and Save accounts as offset accounts to pay less interest on your loan.

You’ll be able to set up a Spend, Bills or Save account as an offset account when you accept your loan offer. If you want to set up more offset accounts or make changes to any of your existing ones, give us a call on 13 30 80.

Update loan type or loan amount

Change your loan to suit you

Switching your loan type

It’s a simple process if you want to change your loan from variable to fixed, or lock in a rate for another fixed period. You might also be able to change from a principal and interest (P&I) loan to an interest only (IO) loan.

For help with changing your loan type, call us on 13 30 80.

Increasing your loan amount

If you need extra funds, we’ll need to have a chat first. Give us a call on 02 9058 7404.

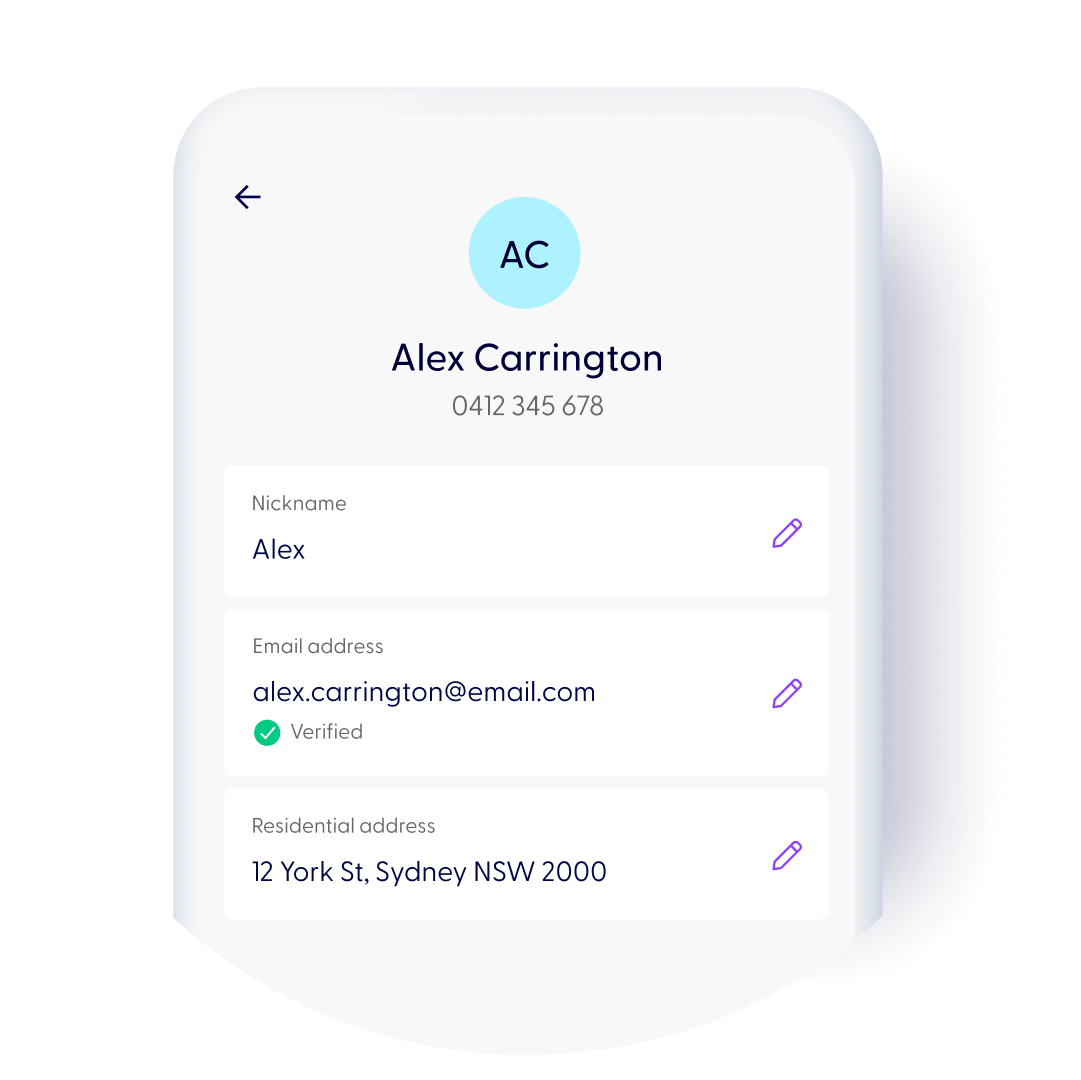

Change details

Need to update your personal details?

To change your personal details, simply head to “Settings” in our app and then tap on your initials on the top right. You can edit your nickname, email address and residential address through the app.

If you need to update your mobile number, please call us on 13 30 80.

Financial hardship

Have you been hit by the unexpected?

We understand that sometimes a change in your circumstances can have a serious impact on your financial situation.

This may arise where:

- You’ve lost your job, or there is a material reduction in your income;

- You have an unexpected illness or medical expense;

- You experience a relationship breakdown;

- You experience a natural disaster; or

You think you might be unable to make your repayments in the future due to some event.

What can we do?

The type of assistance we may give you will depend on your circumstances. We will work with you to determine the most appropriate course of action.

Applying for hardship support

It’s important that you contact us to let us know you’re finding it difficult to meet your loan repayments as soon as you can, so we can discuss your options to help you find a way forward.

You can contact us on 1300 144 550. We’re available between 8 am and 6 pm Monday to Friday (Sydney time).

Everything you tell us will be treated confidentially and all hardship applications are assessed on a case-by-case basis. As part of our assessment, we may ask you to provide us with more information, such as your income and expenses, and documents (e.g., a medical certificate) to support your claim for hardship assistance.

You can nominate someone to discuss your request for help if you prefer (e.g., a financial counsellor, friend or family member). We may ask you to provide us with a written authority in this instance to confirm your request.

Useful links and tools

Make changes with confidence